Georgia Democrat John Barrow took to the floor of the House of

Representatives on Friday afternoon to critique the price of President

Obama’s trip to Africa, as its putative price tag is roughly

the equivalent of the sequester-induced spending cuts in the state of

Georgia.

'Very soon thousands of folks in my district in Georgia, and even

more across the state, will be furloughed as a result of the budget

sequester,” Barrow said. “Studies have shown that the sequester will

cost the Georgia economy approximately $107 million. Meanwhile, reports

circulated this week that President Obama’s upcoming trip to Africa will

cost the taxpayers nearly $100 million.

'Mr. Speaker, no one here questions the need for security for our

Commander-in-Chief. But we do question the need for

such expensive trips when so many folks across the country are being

forced to cut back because Congress can’t get its act together.

A trip of this magnitude isn’t unusual, but these are hard

times. One hundred million dollars could be better used

to keep folks on the job. I urge the President, and everyone at the

federal level, to lead by example, and not take the fact that Congress

can’t get its act together and rub that in the faces of hard working

Americans.'

Meanwhile, the Internal Revenue Service, which has been harassing right-wing groups for years, spends $50 million on a single conference, awarded $500 million in contracts to a company that is qualified under some disable-veterans programme because the contractor suffered an ankle injury playing football at a military prep school decades ago, and is demanding a further $1 billion so that 'things like this won't happen again,' has sent - sit down - 23,994 tax refunds worth a combined $46,378,040 to 'unauthorised' alien

workers, i.e., those that are here illegally and are, by law, unauthorised to work in the United States, who all used the same address in Atlanta, Georgia, in 2011,

according to the Treasury Inspector General for Tax Administration (TIGTA).

From CNS News:

In fact, according to

a TIGTA audit report published last year, four

of the top ten addresses to which the IRS sent thousands of tax refunds to

“unauthorized” aliens were in Atlanta.

The IRS sent 11,284

refunds worth a combined $2,164,976 to unauthorized alien workers at a second

Atlanta address; 3,608 worth $2,691,448 to a third; and 2,386 worth $1,232,943

to a fourth.

Other locations on

the IG’s Top Ten list for singular addresses that were theoretically used

simultaneously by thousands of unauthorized alien workers, included an address

in Oxnard, Calif, where the IRS sent 2,507 refunds worth $10,395,874; an

address in Raleigh, North Carolina, where the IRS sent 2,408 refunds worth

$7,284,212; an address in Phoenix, Ariz., where the IRS sent 2,047 refunds

worth $5,558,608; an address in Palm Beach Gardens, Fla., where the IRS sent

1,972 refunds worth $2,256,302; an address in San Jose, Calif., where the IRS

sent 1,942 refunds worth $5,091,027; and an address in Arvin, Calif., where the

IRS sent 1,846 refunds worth $3,298,877.

Since 1996, the IRS

has issued what it calls Individual Taxpayer Identification Numbers (ITINs) to

two classes of persons: 1) non-resident aliens who have a tax liability in the

United States, and 2) aliens living in the United States who are “not

authorized to work in the United States.”

The IRS has long

known it was giving these numbers to illegal aliens, and thus facilitating

their ability to work illegally in the United States. For example, the Treasury Inspector General’s Semiannual Report to

Congress published on Oct. 29, 1999—nearly fourteen years

ago—specifically drew attention to this problem.

“The IRS issues

Individual Taxpayer Identification Numbers (ITINs) to undocumented aliens to

improve nonresident alien compliance with tax laws. This IRS practice seems

counter-productive to the Immigration and Naturalization Service’s (INS)

mission to identify undocumented aliens and prevent unlawful alien entry,”

TIGTA warned in that long-ago report.

The inspector

general’s 2012 audit report on the IRS’s handling of ITINs was spurred by two

IRS employees who went to members of Congress "alleging that IRS

management was requiring employees to assign Individual Taxpayer Identification

Numbers (ITIN) even when the applications were fraudulent.”

In an August 2012

press release accompanying the audit report, TIGTA said the report “validated”

the complaints of the IRS employees.

“TIGTA’s audit found

that IRS management has not established adequate internal controls to detect

and prevent the assignment of an ITIN to individuals submitting questionable

applications,” said Treasury Inspector General for Tax Administration J.

Russell George. “Even more troubling, TIGTA found an environment which

discourages employees from detecting fraudulent applications.”

In addition to the

23,994 tax refunds worth a combined $46,378,040 that the IRS sent to a single

address in Atlanta, the IG also discovered that the IRS had assigned 15,796

ITINs to unauthorized aliens who presumably used a single Atlanta address.

The IRS, according to

TIGTA, also assigned ITINs to 15,028 unauthorized aliens presumably using a

single address in Dallas, Texas, and 10,356 to unauthorized aliens presumably

living at a single address in Atlantic City, N.J.

Perhaps the most

remarkable act of the IRS was this: It assigned 6,411 ITINs to unauthorized

aliens presumably using a single address in Morganton, North Carolina. According

to the 2010 Census, there were only 16,681 people in Morganton. So, for the IRS

to have been correct in issuing 6,411 ITINS to unauthorized aliens at a single

address in Morganton it would have meant that 38 percent of the town’s total

population were unauthorized alien workers using a single address.

TIGTA said there were

154 addresses around the country that appeared on 1,000 or more ITIN

applications made to the IRS.

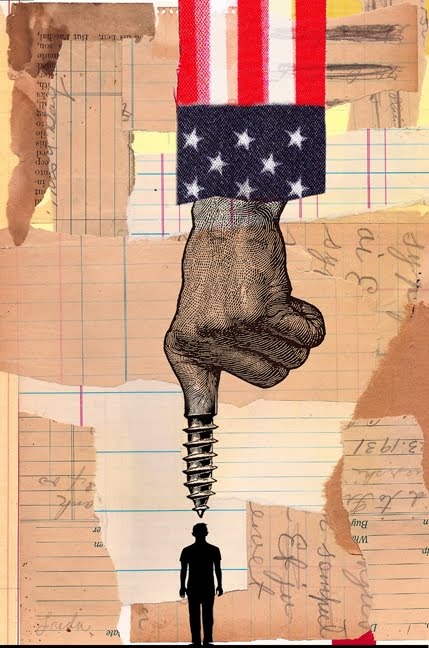

And, they wonder why we are so pissed off at Washington and aren't amenable to 'legalisation first, border security maybe' immigration reform?!?!?

Seriously?

http://tinyurl.com/qddestl

No comments:

Post a Comment