Music to read by:

'Cause nothin' lasts forever

And we both know hearts can change

And it's hard to hold a candle

In the cold November rain

We've been through this such a long long time

Just tryin' to kill the pain

And we both know hearts can change

And it's hard to hold a candle

In the cold November rain

We've been through this such a long long time

Just tryin' to kill the pain

By Walter Russell Mead

“Crisis in the eurozone” stories are getting boring and this is one

two year old soap opera the world would just as soon see disappear.

Nevertheless it grinds on; yesterday the German finance minister said it

could go on for another two years. Unfortunately, he’s right.

But while the news from Europe

is complicated and inconclusive (they are always threatening to jump

off the bridge but so far, no one has), this is still a story one has to

watch. And after months and years when the crisis was mostly in the

hands of elites — heads of government, central bankers and the like — in

the last couple of weeks the public has been getting involved, and that

makes the crisis more dangerous and harder to solve.

The Greek and French elections were the public’s first real chance to

get a word in on how Europe is handling the crisis, and the word from

the public is one of those expletives that we don’t allow at Via Meadia.

The public not only doesn’t approve of the way Europe is handling its

problems; it wants to hang, draw and quarter the people responsible. The

Greeks and the French both voted for candidates who wanted to rip up

the fragile agreements already negotiated; as more European countries

hold elections we must expect that more European politicians will come

to power with mandates to change Europe’s direction. Many like the new

French President François Hollande will try to manage this artfully, but

the Greeks are unlikely to be the only bull in Europe’s china shop by

the time this is done.

The other way that public sentiment threatens to blow Europe sky high is swifter, less predictable and far more dramatic. As Greek savers and investors read the writing on the wall, they are pulling their money out of Greek banks. They know that if Greece pulls out of the euro, the government will do something funny to the banks; they aren’t sure what (nobody really is), but there is a strong suspicion that any money left in Greek bank vaults will be converted from euros to drachmas at the stroke of a pen (more likely, by the tap of a keyboard), and those drachmas will soon be worth much, much less than a euro.

Better to have your money in Swiss or German bank than in a Greek

one, every sentient vertebrate in Greece has to understand; as a result,

hundreds of billions of euros have been moving out of the Greek banking

system. At one point last week, television networks were sending camera

crews out onto the streets to look for panicky customers standing in

line at ATMs or at bank counters; but then they realized that these days

you can do it all on the net. We have entered the age of the invisible

bank run and are waiting for the first virtual panic.

An invisible bank run is a hard thing to watch; not only is it less

telegenic than the old-fashioned kind, one relies on numbers from

official government agencies for statistics. How much money left the

banking system today? How many banks need emergency liquidity to meet

the tide of withdrawals? In the old days, reporters could and did watch

lines form outside the banks and watch the armored trucks arrive with

cash. These days it is happening anonymously and you only know what they

tell you.

They are very unlikely to tell you the truth. Officials lie like rats

in times of financial panic; they do it out of a sense of duty. They

will insist that a given country will never leave the euro until the

moment that it does; they will say that a deposit freeze is unthinkable

until they announce that they’ve done it; they will tell you a bank is

rock solid until the moment they padlock its doors. This is all for your

own good, of course. They don’t want you to panic — and they want to

make sure that your money is trapped when they take it away or turn it

from gold into straw.

Bank runs, even virtual ones, are the method by which public fear can

blow up the eurozone. A bank run, as hundreds of thousands of

depositors decide to pull their money out of a bank or a banking system

at the same time, is the financial equivalent of a dam break. Banks,

even very well run ones, never have all the money that their customers

have deposited in their vaults. They lend that money out to other

people, and because they charge borrowers a higher rate on their loans

than they pay savers on their deposits, they make money.

At least they make money as long as enough of the borrowers can pay back their loans.

When borrowers can’t repay their loans, the bank sooner or later has

to “write down” the value of those loans. In bad economic times, when

borrowers are going bankrupt and the collateral on their loans loses

value, banks can make huge losses. This is how Ireland lost its shirt;

the banking system collapsed as the Irish real estate bubble burst,

making building contractors and home owners bankrupt all over Ireland,

and making the real estate that served as collateral for their loans

almost worthless at the same time. The government — to prevent a panic

and bank runs — guaranteed the deposits held by Irish banks, and ended

up assuming such a massive debt that the Republic of Ireland needed a

bailout from Europe.

Since then, European bailouts have been the safety net for all the

countries in the eurozone. When investors worry that countries like

Spain, Portugal and Italy will have a Greek style financial meltdown and

the interest rates on their bonds rise to reflect that risk, the ECB

steps in to buy their bonds and the panic goes away — for a while. More,

when individual banks are having trouble, the ECB has made huge amounts

of money at extremely low interest rates available to them. Spanish

banks, for example, can borrow cheap money from the ECB in order to buy

Spanish government bonds at high interest rates. They pay one percent

interest to the ECB and collect four percent interest from the Spanish

government, and use the profit of three percent to offset their losses

on their loans to private companies and consumers who are going belly up

in Spain’s savage recession.

The success of this little merry-go-round is why Europe calmed down

last December. The ECB in effect prints money which it gives to busted

banks. The busted banks lend the money to insolvent governments at

artificially low rates (but at rates that still allow the banks to make a

profit). It was a neat little trick that kept the crisis quiet without

forcing the Germans to admit openly that the ECB was in effect using

German resources to bail out the rest of the zone.

Bank runs, even virtual bank runs, would blow this fragile

arrangements to bits. As the prospect of Greece leaving the euro becomes

more likely, savers in Portugal, Spain and Italy have to start

wondering if their countries, too, will have to jump ship. Sophisticated

investors have been moving their money out of those countries for some

time; things may soon reach a pass in which ordinary, unsophisticated

investors start to do the same thing. Again, why have your money in some

gut-shot Spanish bank when you can transfer it to a German, Austrian or

Dutch bank with a mouse click? And if you are worried about the whole

eurozone, or that devious financial trolls will find a way to convert

all deposits held by Spanish citizens in European banks to pesos when

and if the change comes, put the money in Switzerland, the UK or even

the US.

If a few thousands or a few tens of thousands do this in Portugal,

Italy and Spain, no problem. But if hundreds of thousands or millions of

people shift their money out of their home banking systems, then you

have a new and very grave bank crisis that blows the December fix out of

the water. Either the ECB would start creating trillions of euros to

bail out the Club Med banks (and Club Med under some circumstances could

stretch as far north as France), or banking systems start exploding

like firecrackers across the southern tier. At the same time you would

have a new panic on the bond markets; nobody is going to want to own

Spanish or Italian debt under those circumstances.

This is one of those cases when what is good for one is bad for all. A

good financial investor would probably be suggesting to anybody in

Spain or even Italy that it is a good idea to separate the fate of your

savings from the fate of your country’s currency or its banking system.

The trivial costs of moving money into a safer banking system are well

worth the protection you gain.

But if everyone gets and acts on this sound and prudent advice, the

whole banking system and perhaps the whole eurozone comes down.

Europe’s stability now rests on the sloth and stupidity of European

savers. As long as millions of retail investors think their money is OK,

it will be sort of OK for a while. But while governments can and will

lie, and while soothing official pronouncements can be printed up almost

as fast as the ECB produces euros out of thin air, sooner or later

people may start to put two and two together.

Voters are not nearly as scary as depositors right now from the

standpoint of Europe. Elections in Greece can’t cause as much trouble as

bank runs in Barcelona or Turin.

This isn’t an abstract or imaginary worry; on Thursday rumors of a bank run in Spain led to a fall of thirty percent

in the value of Spanish bank shares; the government denied any run was

taking place, and, this time, people believed the denials. The panic

stopped and the next day the bank shares recovered most of the loss.

Bank panics are contagious; everyone who read last week’s stories

about the banking problems in Greece and the rumored problems in Spain

is suddenly aware that the safety of their money is something that they

need to think about. Invisible runs can spread and spread fast; this is

the specter at the feast of the G-8 leaders as they meet at Camp David.

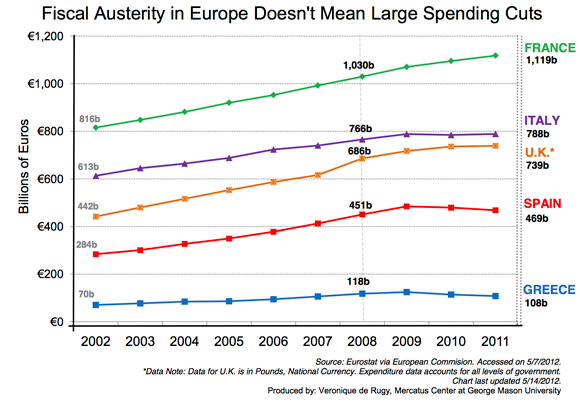

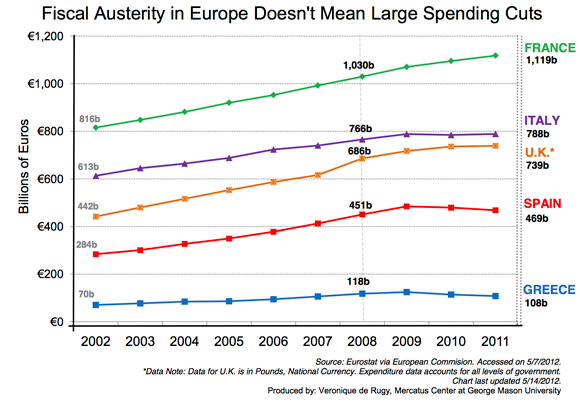

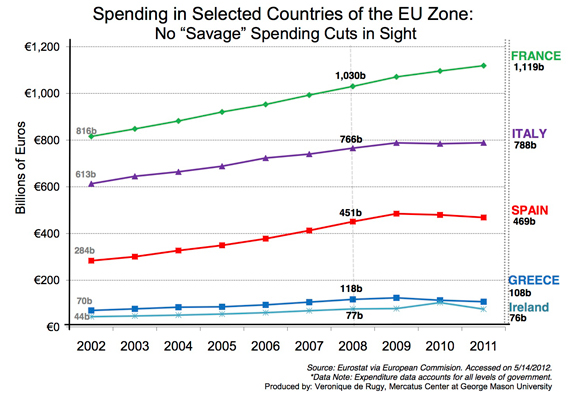

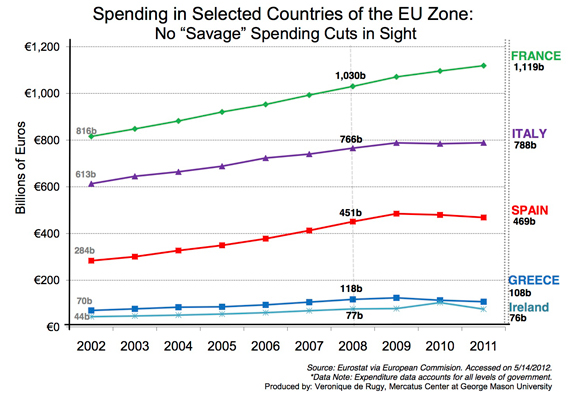

Sophie:

How can "draconian

spending cuts" that have yet to take place be responsible for the European Union's double-dip recession, but the tax rises -- like those advocated by

Barack Obama and François Hollande -- that have been in effect not be

responsible at all?

Related Reading:

Voting For Yesterday In France

Europe, 2012

Uber Alles After All

Bambino, My Cash Money

Europe's Demographic Deficit Grows Wider By The Day

The callous cruelty of the EU is destroying Greece, a once-proud country

November Rain - Guns 'n Roses

When I look into your eyes

I can see a love restrained

But darlin' when I hold you

Don't you know I feel the same

'Cause nothin' lasts forever

And we both know hearts can change

And it's hard to hold a candle

In the cold November rain

We've been through this such a long long time

Just tryin' to kill the pain

But lovers always come and lovers always go

An no one's really sure who's lettin' go today

Walking away

If we could take the time

To lay it on the line

I could rest my head

Just knowin' that you were mine

All mine

So if you want to love me

Then darlin' don't refrain

Or I'll just end up walkin'

In the cold November rain

Do you need some time...on your own

Do you need some time...all alone

Everybody needs some time...

On their own

Don't you know you need some time...all alone

I know it's hard to keep an open heart

When even friends seem out to harm you

But if you could heal a broken heart

Wouldn't time be out to charm you

Sometimes I need some time...on my

Own

Sometimes I need some time...all alone

Everybody needs some time...

On their own

Don't you know you need some time...all alone

And when your fears subside

And shadows still remain

I know that you can love me

When there's no one left to blame

So never mind the darkness

We still can find a way

'Cause nothin' lasts forever

Even cold November rain

Don't ya think that you need somebody

Don't ya think that you need someone

Everybody needs somebody

You're not the only one

You're not the only one

I can see a love restrained

But darlin' when I hold you

Don't you know I feel the same

'Cause nothin' lasts forever

And we both know hearts can change

And it's hard to hold a candle

In the cold November rain

We've been through this such a long long time

Just tryin' to kill the pain

But lovers always come and lovers always go

An no one's really sure who's lettin' go today

Walking away

If we could take the time

To lay it on the line

I could rest my head

Just knowin' that you were mine

All mine

So if you want to love me

Then darlin' don't refrain

Or I'll just end up walkin'

In the cold November rain

Do you need some time...on your own

Do you need some time...all alone

Everybody needs some time...

On their own

Don't you know you need some time...all alone

I know it's hard to keep an open heart

When even friends seem out to harm you

But if you could heal a broken heart

Wouldn't time be out to charm you

Sometimes I need some time...on my

Own

Sometimes I need some time...all alone

Everybody needs some time...

On their own

Don't you know you need some time...all alone

And when your fears subside

And shadows still remain

I know that you can love me

When there's no one left to blame

So never mind the darkness

We still can find a way

'Cause nothin' lasts forever

Even cold November rain

Don't ya think that you need somebody

Don't ya think that you need someone

Everybody needs somebody

You're not the only one

You're not the only one

1 comment:

Great song...

Post a Comment