Music to read by:

Money

Well, get back

I'm all right Jack

Keep your hands off of my stack

Money

It's a hit

Don't give me that do goody good bullshit

I'm in the high-fidelity first class traveling set

I think I need a Lear jet

Money

It's a crime

Share it fairly

But don't take a slice of my pie

Money

So they say

Is the root of all evil today

But if you ask for a raise

It's no surprise that they're giving none away

Well, get back

I'm all right Jack

Keep your hands off of my stack

Money

It's a hit

Don't give me that do goody good bullshit

I'm in the high-fidelity first class traveling set

I think I need a Lear jet

Money

It's a crime

Share it fairly

But don't take a slice of my pie

Money

So they say

Is the root of all evil today

But if you ask for a raise

It's no surprise that they're giving none away

There is only one way out for Europe...and the US now, if the people refuse to take the necessary and bitter medicine of severe budget cuts, and that is inflation. Bond traders are going to charge such high interest rates that it will force these countries into debt spirals. That will not be helpful to their people. So, out comes the printing presses. Hint to readers: Pay for your meal when you order it. If Weimar is any indication, the day may soon come when the price of your meal will double while you are eating it. (only half a snark tag).

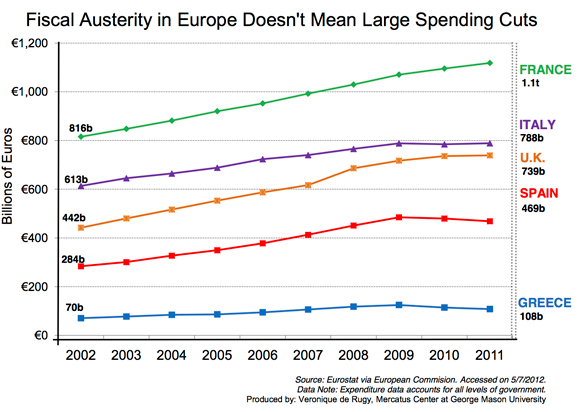

Ryan Avent at The Economist responds to my Corner post, which argued that austerity measures implemented in European countries didn’t necessarily mean “savage” spending cuts as we are led to believe by the anti-austerity headlines. He disagrees. I have a few points to make based on his post:

First, I never said that there is no austerity in Europe as Avent claims. In fact, that’s my point, austerity is taking place in Europe but it’s happening less through brutal spending cuts than through a package of spending cuts and large tax increases. And yes, in some countries, the spending cuts are small or non-existent.

My chart is based on nominal spending data. By the way, if you want to look at the data in real terms go here. It shows the same trend. Also, inflation, population growth, and GDP haven’t changed so radically in the last three years that the use of nominal numbers invalidates the whole argument.

Importantly, as Tyler Cowen points out, nominal spending is what matters in the short run:

The real question addressed by this post is how bad spending cuts have been in nominal terms, keeping in mind in the short run it is supposedly nominal which matters (that said, gdp and population [and inflation] are not skyrocketing in these countries for the most part).Also, as he notes:

It is fine to argue “due to automatic stabilizers, spending should have increased more than it did.” That is not how people phrase it, rather they are complaining rather vociferously about “spending cuts,” many of which are either imaginary or extremely small.Avent then goes on to show data as a share of GDP. First, he has a chart that shows structural budget balance as a share of GDP. From that chart, we see that the structural balances have improved, but, of course, that doesn’t establish that the improvement is the product of only lower spending. It might also have come about by revenue or GDP increases.

This is an important point because my contention all along has been that the term austerity is being misused. The anti-austerity crowd pretends that it means “spending cut” when — more accurately — it means “spending cut, tax increase, or both.”

Also, I have never denied that some countries in my sample (Greece, Spain, and Italy) have cut spending.

Avent’s next chart is supposed to make the point that cumulative spending cuts are responsible for the improvement in structural balances. This data shows a reduction in spending by country has a share of GDP. Yet, that again isn’t the definitive proof it is presented to be since the variation could be the product of: (1) cuts in spending all things, being equal or (2) cuts in spending that are smaller than the increase in GDP. To be sure, increases in GDP in these countries were small. But, as my nominal spending chart showed, so were the spending cuts.

Another comment is that my chart is misleading because of “axis scaling.” I am not sure I understand this point, considering that my axes start at zero (more commonly, people are critiqued for NOT starting at zero).

I like this chart:

It was supposed to address the scale problem in my original chart. It is is also supposed to debunk my main point that spending cuts weren’t as large as we are led to believe. But this actually confirms my argument. Yes, Greece cut spending more than other countries, especially for its size. But Spain and Italy don’t look as if they have dramatically scaled down. And France and the U.K., well, their spending continues to grow.

Now, let’s say that I wasn’t clear or precise enough yesterday. I will try to restate my position more clearly today.

- We need a new word for austerity. Austerity, as defined as an attempt to reduce the debt-to-GDP ratio or deficit, can be achieved by cutting spending, by increasing taxes, or by a mix of both. In other words, there are several forms of austerity.

- When the anti-austerity crowd talks about how austerity has failed in Europe, they always seem to imply that large spending cuts — and spending cuts alone — are responsible for the weak or failing economic growth.

- My chart shows that while some countries have cut spending (these often referred to as the periphery), in most cases these cuts haven’t been spectacularly big. Note, I am not saying they haven’t cut spending.

- Austerity packages are mischaracterized as only made of spending cuts. However, in most cases, austerity measures have been a mix of spending cuts and tax increases. In fact, for Europe as a whole, tax revenues increases were a much larger component than spending cuts. That means, at the very least, austerity failure could be the result of the implementation of spending cuts, tax increases, or both. Yet, anti-austerity critics never acknowledge that tax increases could have played a role — or could be the main reason why things are bad in Europe now. In other words, yes, Greece, for instance, has cut spending a lot relative to its budget. But the Greek government has also massively increased taxes. Why wouldn’t that aspect of the country’s austerity package be worth discussing?

- This omission is all the more puzzling given the fact that most of the austerity literature focuses on the merits of revenue increases vs. spending cuts. My colleague Matt Mitchell had an excellent post last week making this very point. He writes:

Lots and lots of papers* [The asterisk points to 21 peer-reviewed papers] have now studied this question and the evidence is rather clear: the types of austerity that are most-likely to a) cut the debt and b) not kill the economy are those that are heavily weighted toward spending reductions and not tax increases. I am aware of not one study that found the opposite.Now, I think that we will continue to talk past each other. This new post by Washington Post’s Brad Plumer, for instance, argues that yes, there has been austerity in Europe, and that I do not understand what austerity means because it’s not just about spending cuts. That’s him:

But this seems to misunderstand what austerity is. [...] Instead, most countries in the euro zone have done the opposite. They’ve been cutting spending and hiking taxes while the economy’s still weak. This is austerity.So what is it I am not understanding exactly? Because that is exactly my point. I am not saying that there is no austerity in Europe. I am just saying that we need to stop talking about austerity as if all that Europe has done is cut spending. Instead, we should start acknowledging that austerity in Europe means some spending cuts and tax increases. He should know better, because he links to my post so I am assuming that he read it. Here is a tidbit:

The most important point to keep in mind is that whenever cuts took place, they were always overwhelmed by large counterproductive tax increases. Unfortunately, that point is often overlooked. This approach to austerity — some spending cuts with large tax increases — is what President Obama has called the “balanced approach.”I ended with a few wishes yesterday. I will add one more today:

Please, gentlemen, before lecturing me, make sure that you do read what I write.

Update: Brad Plumer has issued the following update to his post.

Update: Veronique de Rugy replies to say she never denied that Europe was engaged in austerity. Her point was that European-style austerity has involved spending cuts and large tax hikes. Fair enough. On that we’re in agreement, and apologies if I misread her. (Whether austerity might have worked better if it had been more heavily tilted toward spending cuts, as she suggests, is a separate and more complicated question.)

Related Reading:

Voting For Yesterday In France

Europe, 2012

Uber Alles After All

Bambino, My Cash Money

Europe's Demographic Deficit Grows Wider By The Day

The callous cruelty of the EU is destroying Greece, a once-proud country

Money - Pink Floyd

Money

Get away

You get a good job with good pay and you're okay

Money

It's a gas

Grab that cash with both hands and make a stash

New car, caviar, four star daydream

Think I'll buy me a football team

Money

Well, get back

I'm all right Jack

Keep your hands off of my stack

Money

It's a hit

Don't give me that do goody good bullshit

I'm in the high-fidelity first class traveling set

I think I need a Lear jet

Money

It's a crime

Share it fairly

But don't take a slice of my pie

Money

So they say

Is the root of all evil today

But if you ask for a raise

It's no surprise that they're giving none away

"HuHuh! I was in the right!"

"Yes, absolutely in the right!"

"I certainly was in the right!"

"You was definitely in the right. That geezer was cruising for a bruising!"

"Yeah!"

"Why does anyone do anything?"

"I don't know, I was really drunk at the time!"

"I was just telling him, he couldn't get into number 2. He was asking why he wasn't coming up on freely, after I was yelling and screaming and telling him why he wasn't coming up on freely. It came as a heavy blow, but we sorted the matter out"

No comments:

Post a Comment