“I rob banks because that's where the money is.”

– Willie Sutton

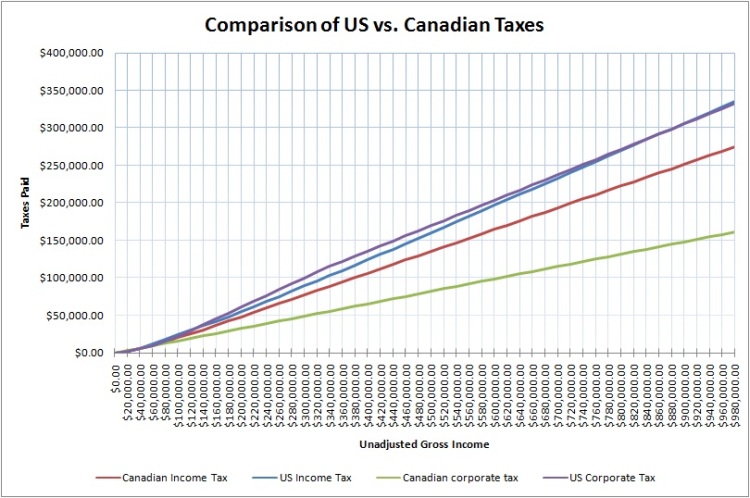

The Left thinks that the rich in America pay a pittance, but is that true?

On 01.01.13, the top marginal tax rate in the United States will automatically rise to 43.4%.

If you are wealthy and live in a state like New York, your combined, marginal tax rate is about 58%.

To put that into context, the top combined, marginal tax rate in COMMUNIST China is 45%.

In PROGRESSIVE Canada, the top marginal tax rate is 29%, the capital gains rate is 10%, and the dividend rate is 19%.

In 2011, Canada’s GDP was $51,147 per person compared to $48,147 in the United States.

Our tax rates are already higher than those in Canada, so we don't even need to factor in the 2013 Obama American Nightmare, but how did our GDP with higher tax rates stack up against Canada's GDP with lower tax rates:

Canada's GDP in 2008 was 0.7%; in 2009: -2.8; in 2010: 3.2; in 2011: 2.5; and in 2012: 2.1; and the forecasted GDP growth rate for 2013 is 3.4%.

America's GDP in 2008 was -0.3%; in 2009: -3.5%; in 2010: 3.0%; in 2011: 1.7%; and in 2012: 1.9%; and the predicted GDP growth rate for 2013 is 2.1%, 2.6% 0r 2.5%-3.0%, depending upon who is doing the forecasting.

On 01.01.13, in Obama's America, the top marginal rate will soon be 43.4%, the capital gains rate will be 23.8%, and the top dividend rate will be 43.4%. There will be a 3.8% investment income surtax, also called the health care surtax or the Medicare tax. This new surtax will be assessed on the lesser of a) net investment income or b) the excess of modified adjusted gross income (MAGI) over the “threshold amount.” For married taxpayers filing jointly, the threshold amount is $250,000; married filing separately, $125,000; all other individual taxpayers, $200,000. For trusts and estates, it is the beginning of the top income tax bracket ($11,650 in 2012). The Inheritance Tax Rate will return to 55% (PLEASE see a financial planner and trust attorney. Also, life insurance proceeds are NOT subject to inheritance/estate taxes). There will also be a 0.9 percent Medicare tax on earned income, which will not be matched by an employer.

The head of the International Monetary Fund, Christine Lagarde, said measures taken to protect Canada’s economy should be a model for countries trying to fix their financial systems and that Canada has been a leader in creating policies intended to rein in the build-up of household debt.

“Abroad, Canada is identified by its values of co-ordination and consensus building, which have given your country influence beyond its years. Building a safe and stable financial system is in the best interests of the global community, but it also serves the self-interest of nations,” she added.

She pointed to the decision by Finance Minister Jim Flaherty to boost down payments on new mortgages for homebuyers as an example of restraint that others should follow.

“All of these new reforms comprise the tools so far that will help us shape the future financial system. We must shape the system so it cannot again hold us ransom to the consequences of its failings.”

Lagarde’s speech focused on global financial reforms that while “heading in the right direction,” still haven’t delivered the safer financial system they were designed to create. “Some financial systems are still under distress and crisis-fighting efforts are inadvertently impeding reforms,” Legarde said.

Canada never had the housing bubble or the financial meltdown. They've always looked at housing and banking differently.

Back during the Great Depression, the United States these idiotic rules that prevented "branching" really destroyed the country's financial system. In other words, banks couldn't have branches in other states. They may get too big for their striped pants and top hats! In my best Edith Bunker voice, "Those were the asinine days..." It's one thing to worry about "Too Big To Fail." It's another thing altogether to put into place a "Too Small To Survive A Bank Run" rule. If you had another branch over yonder in Lawrence, Kansas, it could rustle you up some cash - like real quick - to settle down your customers in Belton, Missouri. But, nooooooo! Someone might get to wear a monocle instead of spectacles like the rest of dem po folk.

Between the Crash of 1929 and 1941, over 9,000 banks failed in the United States and that included years after the passage of The Truth in Federal Securities Act of 1933, The Emergency Banking Relief Act of 1933, The Banking Act of 1933 a/k/a the Glass–Steagall Act, which created the Federal Deposit Insurance Corporation, the Securities and Exchange Commission of 1934, the Federal Trade Commission, the unconstitutional National Industrial Recovery Act of 1933, the unconstitutional Agricultural Adjustment Act of 1933, expanded Hoover's Reconstruction Finance Corporation, expanded Hoover's Federal Emergency Relief Administration and then named it the Works Progress Administration in 1935, and so many more projects, programmes, diktats, boards, experts, think tanks comprised of experts, etc.

Between the Crash of 1929 and 1941, NO banks failed in Canada. None. Zip. Zilch. Nada.

In PROGRESSIVE Canada, the top marginal tax rate is 29%, the capital gains rate is 10%, and the dividend rate is 19%.

In 2011, Canada’s GDP was $51,147 per person compared to $48,147 in the United States.

Our tax rates are already higher than those in Canada, so we don't even need to factor in the 2013 Obama American Nightmare, but how did our GDP with higher tax rates stack up against Canada's GDP with lower tax rates:

Canada's GDP in 2008 was 0.7%; in 2009: -2.8; in 2010: 3.2; in 2011: 2.5; and in 2012: 2.1; and the forecasted GDP growth rate for 2013 is 3.4%.

America's GDP in 2008 was -0.3%; in 2009: -3.5%; in 2010: 3.0%; in 2011: 1.7%; and in 2012: 1.9%; and the predicted GDP growth rate for 2013 is 2.1%, 2.6% 0r 2.5%-3.0%, depending upon who is doing the forecasting.

On 01.01.13, in Obama's America, the top marginal rate will soon be 43.4%, the capital gains rate will be 23.8%, and the top dividend rate will be 43.4%. There will be a 3.8% investment income surtax, also called the health care surtax or the Medicare tax. This new surtax will be assessed on the lesser of a) net investment income or b) the excess of modified adjusted gross income (MAGI) over the “threshold amount.” For married taxpayers filing jointly, the threshold amount is $250,000; married filing separately, $125,000; all other individual taxpayers, $200,000. For trusts and estates, it is the beginning of the top income tax bracket ($11,650 in 2012). The Inheritance Tax Rate will return to 55% (PLEASE see a financial planner and trust attorney. Also, life insurance proceeds are NOT subject to inheritance/estate taxes). There will also be a 0.9 percent Medicare tax on earned income, which will not be matched by an employer.

The head of the International Monetary Fund, Christine Lagarde, said measures taken to protect Canada’s economy should be a model for countries trying to fix their financial systems and that Canada has been a leader in creating policies intended to rein in the build-up of household debt.

“Abroad, Canada is identified by its values of co-ordination and consensus building, which have given your country influence beyond its years. Building a safe and stable financial system is in the best interests of the global community, but it also serves the self-interest of nations,” she added.

She pointed to the decision by Finance Minister Jim Flaherty to boost down payments on new mortgages for homebuyers as an example of restraint that others should follow.

“All of these new reforms comprise the tools so far that will help us shape the future financial system. We must shape the system so it cannot again hold us ransom to the consequences of its failings.”

Lagarde’s speech focused on global financial reforms that while “heading in the right direction,” still haven’t delivered the safer financial system they were designed to create. “Some financial systems are still under distress and crisis-fighting efforts are inadvertently impeding reforms,” Legarde said.

Canada never had the housing bubble or the financial meltdown. They've always looked at housing and banking differently.

For example, Congressman Louis

McFadden was a Republican and Chairman of the United States House Committee on

Banking and Currency acting on the recommendation of the Comptroller of the

Currency, Henry May Dawes (The Great-grandfather of Bill Schultz of Red Eye

fame!) pushed through The McFadden Act of 1927.

The Act, specifically, prohibited interstate branch banking in the

United States., and only allowed banks to open branches within the single state

in which it was chartered. Therefore, U.S. banks were forced to be small and

local, with an undiversified loan portfolio tied to the local economy of a

single state, or a specific region of a single state. Granted, the intentions

behind the Act were fairly noble coming after the Robber Baron Age and the fast-n-loose

playing rules that necessitated the Sherman Antitrust Act, but the strict

regulatory framework of the McFadden Act created a delicate and fragile banking

system that could not easily withstand the shock of the Great Depression.

Back during the Great Depression, the United States these idiotic rules that prevented "branching" really destroyed the country's financial system. In other words, banks couldn't have branches in other states. They may get too big for their striped pants and top hats! In my best Edith Bunker voice, "Those were the asinine days..." It's one thing to worry about "Too Big To Fail." It's another thing altogether to put into place a "Too Small To Survive A Bank Run" rule. If you had another branch over yonder in Lawrence, Kansas, it could rustle you up some cash - like real quick - to settle down your customers in Belton, Missouri. But, nooooooo! Someone might get to wear a monocle instead of spectacles like the rest of dem po folk.

Between the Crash of 1929 and 1941, over 9,000 banks failed in the United States and that included years after the passage of The Truth in Federal Securities Act of 1933, The Emergency Banking Relief Act of 1933, The Banking Act of 1933 a/k/a the Glass–Steagall Act, which created the Federal Deposit Insurance Corporation, the Securities and Exchange Commission of 1934, the Federal Trade Commission, the unconstitutional National Industrial Recovery Act of 1933, the unconstitutional Agricultural Adjustment Act of 1933, expanded Hoover's Reconstruction Finance Corporation, expanded Hoover's Federal Emergency Relief Administration and then named it the Works Progress Administration in 1935, and so many more projects, programmes, diktats, boards, experts, think tanks comprised of experts, etc.

Between the Crash of 1929 and 1941, NO banks failed in Canada. None. Zip. Zilch. Nada.

Whenever there is a problem, Americans say, 'There oughta be a law!"

Whenever American politicians see something that they do not think

is fair, they say, "There needs to be a law and/or regulation!"

Canada didn't have a housing crisis because it doesn't have a policy that says: Every Canadian should own a home. Homeownership is a fundamental right.

Canada didn't have a housing crisis because it didn't set out to push square mortgage applicants into round mortgage lenders with the Sword of Damocles hanging over the head of the bank.

* Heading into the crisis, banks here were under stricter rules, forced to set aside more capital than U.S. firms and managed with a more conservative bent. Government agencies such as the Canada Mortgage and Housing Corp. hewed closely to policies in which they supported the housing market by offering mortgage insurance, but unlike Fannie Mae and Freddie Mac in the United States, they were never expected to encourage homeownership as a social or economic end.

* Canadian tax law is neutral: Interest on mortgage payments is not deductible, a fact that encourages home buyers to make larger down payments and avoid withdrawing equity. The banks themselves expect to hold on to the mortgages they make and collect the interest. Most loans allow interest rates to be reset after five years, and most also carry prepayment penalties -- rare in the United States.

* There are no 0%, 5%, or 10% downpayments. There are no no-doc loans. Most buyers put down between 15% and 20% and take out only 15 year loans.

* "Fundamentally, what we have seen is the Canadian housing market responding to the dynamics of supply and demand," Craig Alexander, TD Bank's chief economist said. He contrasted that with a U.S. housing market driven by loose lending standards and by Wall Street demand for mortgages to be bundled and sold as securities: "The mortgages made in Canada are mortgages that banks are quite happy to keep on their balance sheets."

* Subprime mortgages in Canada accounted for only about 5 percent of the loans originated by local banks during the housing boom, compared with more than 20 percent in the United States.

* And while U.S. housing has remained sluggish, the Canadian market is showing so much life that the Bank of Canada recently raised interest rates and regulators have taken other steps to temper demand -- for example, tightening mortgage qualification rules. Meanwhile, the Obama administration is demanding loosening qualification rules. Who didn't know that?

In "PROGRESSIVE" Canada, on 1 January 2012, Canada's federal corporate tax rate automatically fell to 15% from 16.5% as the last installment of a series of corporate rate cuts launched in 2006 by the administration of Prime Minister Stephen Harper. When Harper initiated his campaign, Canada's overall corporate tax rate was 33.9% according to the OECD, third-lowest in the G-7. The federal corporate rate was 22% and the average provincial rate was 11.8%. Today, Canada now has an overall (Federal and provincial) corporate tax rate of 25%, the lowest rate of the G-7 nations.

Small businesses today have a special, lower rate of 11%.

The Left thinks the corporations in the United States have it easy (Some do. I'm looking at you, General Electric, Mr Obama's Chairperson of the Council on Jobs and Competitiveness, Jeffrey Immelt, and Google, who paid a whopping effective rate of 2%), but do they? A few do, but most don't. Not every corporation is an Apple, Halliburton, Google, GE, etc. Most of small businesses.

The United States has the highest combined corporate income tax rate in the world at 39.21%, which will rise to 46.2% in 2013 before any Obamacare taxes or new taxes under Obama take effect.

To put that into perspective, COMMUNIST China's combined corporate income tax rate is 25%. That's right. The Commies allow you to keep more of your own money!!!

Brasil's corporate rate is 25% and it is an emerging economy. Russia’s corporate rate is 20% and India’s is a 33.9% statutory tax rate.

The average corporate tax rate in the "SOCIALIST" EU is 23.5%. The lowest rates were in Bulgaria and Cyprus at 10%. Ireland barely lost out because its corporate rate is 12.5%. Belgium, which didn't even have a government for more than a year and has a strong, separatist movement, has the highest corporate rate at 33.99%. Socialist France almost beats Belgium with a corporate tax rate of 33.33%.

I feel fairly certain that France will take over the #1 spot in all tax categories soon even though diminishing returns are already starting to appear. The 4th wealthiest man in the world, the wealthiest man in Europe, and the wealthiest man in France, Bernard Arnault, who runs luxury giant LVMH Moët Hennessy Louis Vuitton and has an estimated net worth of $41 billion confirmed news reports from Belgium that he applied for citizenship there in September. He's hardly the only one...just the richest, but what makes news? The 4th richest man in the world or a whole bunch of millionaires moving to London to set up work in The City? Even Karl Lagerfeld's feathers are flying!!!

“This idiot will be as disastrous as (Former Spanish Socialist Prime MinisterJose Luis Rodriguez) Zapatero was. It’s a disaster. He wants to punish (the rich) and of course they

leave and no one invests. Foreigners don’t want to invest in

France and that’s just not going to work. Outside of fashion, jewellery, perfume and wine, France isn’t

competitive. The rest of our products don’t sell. Who

buys French cars? I don’t.”

- Karl Largerfeld,on President François Hollande's decision to further tax the rich,Spanish Marie Claire, October 2012

I ain't no fooling either (or birthin dem babies).... on 01.04.12, Great Britain will lower its corporate rate to 25% from 26%. Britain's rate is schedule to fall even further to 23% by 2014. I'm thinking that the Official Monster Raving Loony Party needs to have a major bash with the ghostlyy Screaming Lord Sutch and the Savages headlining. Safety-pin earrings, black ripped stockings, purple hair, and bang your head to 23% corporate tax rates!!!

Sitting, Facing Forward!!!

And, before you start, yes, China, Canada, Brasil, Russia, India, Belgium, etc., ALL have deductions for operating expenses...just like the US.

Furthermore, ONLY the United States taxes the profits of its corporations when made overseas and on which the entities have already paid taxes in the situs of earnings. I told you bloody geniuses that, if you allowed the repatriation of the $2.3 trillion that is currently sitting in corporate foreign bank accounts tax free provided it is spent on R&D, expansion, distributions, or new hires, you'd have the biggest bloody stimulus in history. It would make the Supercalifragilisticexpialidocious Stimulus Act

of 2009 look like one of The Ferret's droppings.

According to the OECD, the United States has the most progressive individual tax system in the world. While it is true that tax rates on the uber-wealthy are certainly higher in some countries, the tax base is much wider. There isn’t a country in Europe where 47-52% of the working population avoids paying national income tax.

For example, a senior level nurse in a London hospital earns approximately $49,000. She will pay around $10,500 in income taxes, $6,039 in National Insurance taxes, a 20% VAT, council taxes, and other assorted taxes…in an area where it is more expensive to live than in Manhattan or San Francisco.

For example, a senior level nurse in a London hospital earns approximately $49,000. She will pay around $10,500 in income taxes, $6,039 in National Insurance taxes, a 20% VAT, council taxes, and other assorted taxes…in an area where it is more expensive to live than in Manhattan or San Francisco.

The wealthy in the United States shoulder a far, far greater “fair share” of the burden than their counterparts elsewhere.

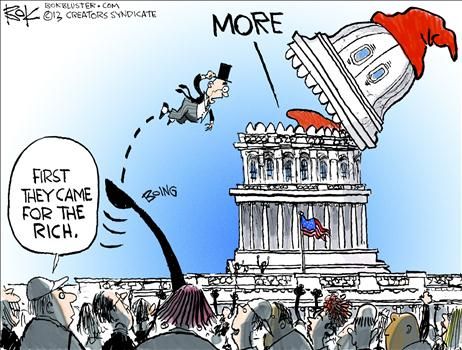

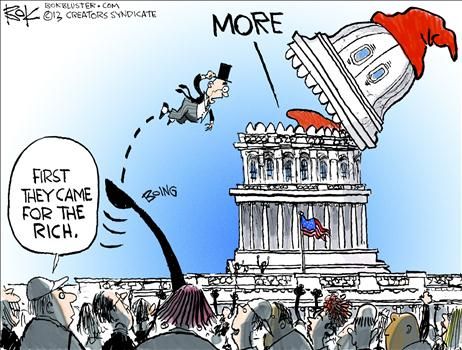

Eventually, Obama must levy his tax increases at lower income levels because that's where the money is and there just aren’t enough millionaires and billionaires to pay for the Federal government that he wants. Truth be told, there aren’t enough middle class taxpayers to pay for it either.

In 2009, 237,000 taxpayers reported income above $1 million and they paid $178 billion in taxes. A mere 8,274 filers reported income above $10 million, and they paid only $54 billion in taxes.

But 3.92 million reported income above $200,000 in 2009, and they paid $434 billion in taxes. To put it another way, roughly 90% of the tax filers, who would pay more under Mr Obama's plan aren't millionaires, and 99.99% aren't billionaires.

Between 2007 and 2010, the number of those earning:

$200,000 per year declined by 13%

$1 million per year declined by 39%

$10 million per year declined by 55%

The more a government relies on a smaller number of taxpayer, the more it is setting itself up for a cataclysmic event when the market turns. Nowhere is this more evident than in places like California.

In 2006, for example, according to the Franchise Tax Board, Californians making more than $500,000 a year filed just 1% of all state income tax returns — and paid 47.2% of the taxes. When the recession hit, the wealthy saw their incomes drop sharply, which resulted in a dramatic drop in tax revenues.

In 1990, the highest individual income tax rate of our major economic trading partners was 51%, while the U.S. was much lower at 33%. It's no wonder that during the 1980s and '90s the U.S. created more than twice as many new jobs as Japan and Western Europe combined.

According to the OECD, over the past two decades the average highest tax rate among the 20 major industrial nations has fallen to about 45%. Yet the highest U.S. tax rate would rise to more than 43.4% no counting the proposed "Alternative Minimum Millionaires' Tax." To make matters worse, if we include the average personal income tax rates of developing countries like India and China, the average tax rate around the world is closer to 30%, according to a new study by KPMG.

The more a government relies on a smaller number of taxpayer, the more it is setting itself up for a cataclysmic event when the market turns. Nowhere is this more evident than in places like California.

In 2006, for example, according to the Franchise Tax Board, Californians making more than $500,000 a year filed just 1% of all state income tax returns — and paid 47.2% of the taxes. When the recession hit, the wealthy saw their incomes drop sharply, which resulted in a dramatic drop in tax revenues.

In 1990, the highest individual income tax rate of our major economic trading partners was 51%, while the U.S. was much lower at 33%. It's no wonder that during the 1980s and '90s the U.S. created more than twice as many new jobs as Japan and Western Europe combined.

According to the OECD, over the past two decades the average highest tax rate among the 20 major industrial nations has fallen to about 45%. Yet the highest U.S. tax rate would rise to more than 43.4% no counting the proposed "Alternative Minimum Millionaires' Tax." To make matters worse, if we include the average personal income tax rates of developing countries like India and China, the average tax rate around the world is closer to 30%, according to a new study by KPMG.

"You can't rob a bank on charm and personality.”

- Willie Sutton

Not even dictators can govern for long on charm and personality, Presidents' days of getting away with it are even shorter.

Only time will tell how long the middle class will stand for allowing the Great Leviathan to rob them with charm, personality, or anything else.

________________________________________________________________

Average Federal Income Taxes Paid, as Percent of Income

Income..................Average tax rate

Under $75K.....................6.6%.......

$75K to $100K................8.5%.......

$100K to $200K.............11.9%.....

$200K to $500K.............19.6%....

$500K to $1M..................24.4%...

$1M to $1.5M...................25.3%...

$1.5M to $2M...................25.6%...

$2M to $5M......................25.8%...

$5M to $10M...................25.4%...

$10M or more.................22.6%..

http://www.irs.gov/taxstats/indtaxstats/article/0,,id=134951,00.html

From Obama's Neo-Nationalism II:

"Osawatomie" was the name chosen by the Weather Underground for its newsletter, which praised Communists like Mao and Ho Chi Minh. So in keeping with the flotsam and jetsam spewed in Obama's buddy, William Ayers' publication, let's pretend that, instead of proposing to raise the top income tax rate well north of 40%, Obama decided to go all-out Communist and tax the wealthy at 100%. Would this bring about the nirvana of which Obama brays continuously? Hardly.

Consider the income tax statistics for the year 2008 as compiled by the Internal Revenue Service. The top 1% of taxpayers -- those with salaries, dividends and capital gains roughly above about $380,000 -- paid 38% of taxes. But, if the tax policy had been to confiscate ALL of the taxable income earned by the "millionaires and billionaires," whom Obama has chosen, frozen, and targeted for special Alinksy-type treatment, the yield from that total haul would be a mere $938 billion, which is not even a quarter of the money that the Obama administration spends annually (25% as a share of the economy, a post-World War II record) and much less than the amount it wants to spend in the next decade per the President's own budget. Total confiscation would leave you still with $3.1 trillion deficit instead of a $1.5 trillion deficit.

Since the "millionaires and billionaires" aren't going to do it for Mr Obama, say we apply the 100% income tax rate to the top 10%, or everyone with income over $114,000, including joint filers. Yes, that's five times Mr Obama's 2% promise, but, hey, Promises! Promises! The IRS data are broken down at $100,000, yet taxing all income above that level throws up only $3.4 trillion and remember, the top 10% already pay 69% of all total income taxes, while the top 5% pay more than all of the other 95%. We would STILL have a deficit AND you can bank this: Next year, you will not find many individuals earning more than $100,000.

I recognise that 2008 was a bad year for the economy and thus for tax receipts, as the income of the "evil rich" is always more volatile and susceptible to fluctuations in the economy. So, let's do the same with 2005 income (Ahem, it was a banner year of amazing tax receipts due to the Bush tax cuts that Obama loathes and blames for every ill ever to plague mankind). In 2005, the top 5% earned over $145,000. If all the income of people earning over $200,000 was taxed at 100% a/k/a confiscation, it would yield about $1.89 trillion, enough revenue to cover the 2012 bill for Social Security, Medicare, and Medicaid -- but not the same bill in 2014 or 2020 since the costs of these entitlements alone are expected to grow exponentially and rapidly. In short, the "evil rich" aren't nearly rich enough to finance the welfare state ambitions of Obama and that's before Obamacare even kicks into gear.

So who else is there to tax? Well, in 2008, there was about $5.65 trillion in total taxable income from all individual taxpayers, and most of that came from Middle Class income taxpayers. The chart below shows the distribution, and the big hump in the center is where Democrats are inevitably headed for the same reason that Willie Sutton robbed banks.

There are roughly 1,210 billionaires in the world. Their total net wealth is approximately $4.5 trillion. If Obama took all their money - including that of the non-Americans, he could fund his government for approximately 1.3 years.

"Those Bush tax cuts quickly ended the 2001 recession, despite the contractionary economic impacts of 9/11, and the economy continued to grow for another 73 months. After the rate cuts were all fully implemented in 2003, the economy created 7.8 million new jobs and the unemployment rate fell from over 6% to 4.4%. Real economic growth over the next 3 years doubled from the average for the prior 3 years, to 3.5%.

In response to the rate cuts, business investment spending, which had declined for 9 straight quarters, reversed and increased 6.7% per quarter. That is where the jobs came from. Manufacturing output soared to its highest level in 20 years. The stock market revived, creating almost $7 trillion in new shareholder wealth. From 2003 to 2007, the S&P 500 almost doubled. Capital gains tax revenues had doubled by 2005, despite Bush's 25% cut in the capital gains rate.

The deficit in the last budget adopted by Republican Congressional majorities was $161 billion for fiscal 2007. Today that deficit is nearly 10 times as much. Total federal revenues under Bush soared by nearly 30%, from $1.991 trillion in 2001 to $2.568 trillion in 2007. The day the Democrat Congressional majorities took office, January 3, 2007, the unemployment rate was 4.6%. George Bush's economic policies, "the failed policies of the past" in Obama's rhetoric, had set a record of 52 straight months of job creation."

According to the Bureau of Labor Statistics, job growth has been slower under Obama than under Bush: 40,500 jobs a month versus 68,000 jobs per month.

Mr Obama likes to argue that the "massive deficits" are the result of the Bush tax cuts and that returning to the Clinton tax rates, at least, for the wealthy would solve the fiscal problems. As we have seen, the "evil rich" aren't rich enough to fund his grandiose government, but his claims about the cause of the deficits is equally ridiculous. According to the Congressional Budget Office, the Bush and Obama tax cuts are responsible for less than 24% of the deficits accumulated in the last decade. Data provided by the CBO shows that the largest cause of deficits was increased spending, which accounted for 36.5% of the decline in the fiscal position of the United States over the last decade and entitlements are responsible for the rest.

More importantly, President Obama seeks to retain 70% of the Bush tax cuts, along with his payroll tax cut. When will he start taking responsibility for the deficits that he not only has generated, but will create? If the Bush tax cuts caused the deficits, then isn't Obama responsible for 70% of future deficits, at minimum, should he retain most of them?

Further, according to the Washington Post, "it is best to ignore raw numbers but instead focus on the size of the tax cut as a percentage of national income. Under that measure, the John F Kennedy tax cut of 1964 (-1.90%) and the Ronald Reagan tax cut of 1981 (-1.40%) were larger than Bush’s 2001 tax cut (-0.80%)."

Another idiosyncrasy that Obama has is to impute illegality to lawful behaviour. He will rail against the use, by corporations and "rich people," of loopholes and deductions, as though such is a crime. Let us be reminded of the famous axiom of Judge Learned Hand:

According to Obama, it is also fair to raises taxes on the top 2 brackets while further lowering payroll taxes, which pay current Social Security benefits and are the consideration that this generation of workers makes in order to receive such benefits when they retire.

Do Obama and Democrats even realise the consequences of their position? They are turning Social Security, etc., into welfare programmes, which Franklin Delano Roosevelt and the Progressives that created Social Security were vehemently against, and is undermining the precarious financial condition of them.

What is going to happen when politicians want to allow the payroll tax cut to expire? Will they be allowed to do so by a public that likes claiming that it is paying now for their retirement later, but, in reality, aren't paying at all or doing so in a de minimis fashion?

The "evil rich" do not have the money to fund Social Security and Medicare even if they are taxed at 100% much less just removing the cap on $106,800. Without the payroll taxes collected from all workers, Social Security and Medicare will generate even greater deficits than now and there will be reluctance by politicians to end the tax cut because, as Democrats have argued, it would raise taxes on the marginalised Middle Class. Thus, Democrats will continue to choose to undermine the very social safety net that they profess to champion. When will they be forced (by the bond market and demographics) to tell Americans that they will have no Social Security and Medicare in the future?

This statement is quite possibly the biggest lie that Obama has ever uttered. "Even before Obama was elected, under those "failed policies of the past," the top 1% of income earners in 2007 paid 40% of federal income taxes (up from 17.6% when Reagan entered office), while the CBO just reported that they earned 17% of the income in 2007. Moreover, that 40% of federal income taxes paid by the top 1% was more than paid by the bottom 95% combined, according to official IRS data. While the top 1% paid 40% of federal income taxes, the bottom 40% paid no federal income taxes as a group on net. Today, 47% pay no federal income taxes."

Far from letting the "evil rich" off the hook, Obama has seen to it that the nation's job creators, investors and small businesses will face massive tax increases in 2013 when the Bush tax cuts expire and the Obamacare tax rises go into effect. In that year, the top marginal rate will rise to 43.4% and the 2 rates will rise to by nearly 20%, the capital gains rate will skyrocket by 60%, the tax on dividends will triple, and the Medicare payroll tax on disfavoured taxpayers will increase by 62%. While Mr Obama and Democrats continue to repeat the 2008 mantra about returning to the Clinton tax rates, the tax rates on the top two brackets will far exceed those rates in 2013.

As I have previously written, the United States has, according to the OECD, the most progressive individual income tax system in the world and the highest corporate tax rate in the industrialised world at close to 40% on average, including state corporate rates. Further, as I have noted, the corporate tax rate in Communist China is only 25%. The average corporate tax rate in Socialist EU is even less on average and the rate in Progressive Canada is 16.5% and will be 15% next year.

- Barack Obama, Oswatomie, Kansas, 6 December 2011

One would be tempted to call Mr Obama a liar here, but it is much more likely the case that this statement is just another example of his complete ignorance and idiocy when it comes to economics and economic history. Previously, I have explained the economics of the Roaring 20s, which were called that for a reason. These would be the years 1921-1929, when on account of a tax cut put together in 1921, the economy boomed at 4.8% per year as unemployment and inflation (the latter recently on a 100% run) both collapsed. You can read more about it here. I have also explained how, "If You Want Obamavilles, Repeat What Hoover Did" and you can read that piece here. I will say this:

Between 1945 and 1960, there were 5 recessions - many more than occur in a normal cycle. February through October 1945, November 1948 through October 1949, July 1953 through May 1954, August 1957 through April 1958, and April 1960 through February 1961. The trough of the recession at the end of World War II was 1947, when the Republican majority in Congress conspired to win a tax cut over President Truman’s veto. Result: a 6-year run of 4.8% growth.

When the recession came in 1953, Eisenhower refused calls for another tax cut and, as a result, there were 3 recessions during his administration and, when Eisenhower left office in January of 1961, he had presided over 8 years of an anemic 2.4% annual, average growth rate. In large part, that sluggish growth was due to high tax rates, not just on the wealthy, but on the middle class as well. In fact, increasing tax rates on the wealthy led to increases in tax rates on middle-class incomes.

Vice-President Richard Nixon paid a price for what Obama called this "incredible postwar boom." He lost to John F Kennedy, who -- all together now -- CUT TAXES.

After Kennedy's tax cut, which according to the Washington Post was the largest in history, the great 1960s boom ensued, with an average growth GDP growth rate of 4.9% between 1961 to 1969. Furthermore, between 1962 and 1969, investment grew at an annual rate of 6.1% far higher than the 3% annual rate for 1959-1962 and the 2.3% rate for 1969-1972, after the JFK tax reforms had been repealed. Real GNP grew 4.5% during the 1960s, higher than the 2.4% growth rate seen from 1952-1960.

So, what has NEVER worked is Keynesian economics. What is not working now is Obamanomics. What has continued to fail us now is that Obama's own policies, the exact opposite of what has worked in the past in every detail, have failed to produce any timely real recovery from the last recession. Prior to this last recession and since the Great Depression, recessions in the United States have lasted an average of 10 months, with the longest being only 16 months. Further, all data proves that the deeper the recession in the United States, the more robust the recovery ... that is, until now. Here we are, 48 months after the commencement of the most recent recession and there is no sign of any real recovery. Rather than a record recovery, we have record poverty, record food stamp usage, record child homelessness, record depressed prices in the housing market, record extended unemployment, and near records in fear of big government, distrust of our leaders and political system, and disapproval in the direction in which the country is heading.

Instead of changing course and adopting pro-growth and economic freedom policies, Obama pledges to give us more of what we do not want: A New Nationalism. For what it is worth, Theodore Roosevelt can be forgiven to a degree for falling for National Socialism / Socialism /Progressivism. After all, collectivism hadn't killed nearly 200 million people yet. Obama should know better, but classic narcissists believe that they can succeed where all others have failed.

________________________________________________________________

Average Federal Income Taxes Paid, as Percent of Income

Income..................Average tax rate

Under $75K.....................6.6%.......

$75K to $100K................8.5%.......

$100K to $200K.............11.9%.....

$200K to $500K.............19.6%....

$500K to $1M..................24.4%...

$1M to $1.5M...................25.3%...

$1.5M to $2M...................25.6%...

$2M to $5M......................25.8%...

$5M to $10M...................25.4%...

$10M or more.................22.6%..

http://www.irs.gov/taxstats/indtaxstats/article/0,,id=134951,00.html

From Obama's Neo-Nationalism II:

"Osawatomie" was the name chosen by the Weather Underground for its newsletter, which praised Communists like Mao and Ho Chi Minh. So in keeping with the flotsam and jetsam spewed in Obama's buddy, William Ayers' publication, let's pretend that, instead of proposing to raise the top income tax rate well north of 40%, Obama decided to go all-out Communist and tax the wealthy at 100%. Would this bring about the nirvana of which Obama brays continuously? Hardly.

Consider the income tax statistics for the year 2008 as compiled by the Internal Revenue Service. The top 1% of taxpayers -- those with salaries, dividends and capital gains roughly above about $380,000 -- paid 38% of taxes. But, if the tax policy had been to confiscate ALL of the taxable income earned by the "millionaires and billionaires," whom Obama has chosen, frozen, and targeted for special Alinksy-type treatment, the yield from that total haul would be a mere $938 billion, which is not even a quarter of the money that the Obama administration spends annually (25% as a share of the economy, a post-World War II record) and much less than the amount it wants to spend in the next decade per the President's own budget. Total confiscation would leave you still with $3.1 trillion deficit instead of a $1.5 trillion deficit.

Since the "millionaires and billionaires" aren't going to do it for Mr Obama, say we apply the 100% income tax rate to the top 10%, or everyone with income over $114,000, including joint filers. Yes, that's five times Mr Obama's 2% promise, but, hey, Promises! Promises! The IRS data are broken down at $100,000, yet taxing all income above that level throws up only $3.4 trillion and remember, the top 10% already pay 69% of all total income taxes, while the top 5% pay more than all of the other 95%. We would STILL have a deficit AND you can bank this: Next year, you will not find many individuals earning more than $100,000.

I recognise that 2008 was a bad year for the economy and thus for tax receipts, as the income of the "evil rich" is always more volatile and susceptible to fluctuations in the economy. So, let's do the same with 2005 income (Ahem, it was a banner year of amazing tax receipts due to the Bush tax cuts that Obama loathes and blames for every ill ever to plague mankind). In 2005, the top 5% earned over $145,000. If all the income of people earning over $200,000 was taxed at 100% a/k/a confiscation, it would yield about $1.89 trillion, enough revenue to cover the 2012 bill for Social Security, Medicare, and Medicaid -- but not the same bill in 2014 or 2020 since the costs of these entitlements alone are expected to grow exponentially and rapidly. In short, the "evil rich" aren't nearly rich enough to finance the welfare state ambitions of Obama and that's before Obamacare even kicks into gear.

So who else is there to tax? Well, in 2008, there was about $5.65 trillion in total taxable income from all individual taxpayers, and most of that came from Middle Class income taxpayers. The chart below shows the distribution, and the big hump in the center is where Democrats are inevitably headed for the same reason that Willie Sutton robbed banks.

"Some billionaires have a tax rate as low as 1 percent — 1 percent. That is the height of unfairness."

- Barack Obama, Osawatomie, Kansas, 6 December 2011

- Barack Obama, Osawatomie, Kansas, 6 December 2011

The White House could offer nothing more than a

clip of a conversation on Bloomberg TV, in which correspondent Gigi Stone made

this assertion during a discussion about the tax strategies that the very

wealthy use to avoid paying taxes. The TV clip was promoted by the left-leaning Web site Think

Progress, but Stone cited an article

which made no such claim. In fact, the evidence proves the opposite of Mr

Obama's claim.

In 2008, of the top 400 taxpayers, 30 paid an

average tax rate of between zero and 10%, 59 paid an average tax

rate of 30-35%, while 238 paid a marginal tax rate

of 35% and above. Of the top 400 taxpayers, only 17 had a marginal rate

of 0-26%. The average tax paid by the individuals in this group was

nearly $50

million.

There are roughly 1,210 billionaires in the world. Their total net wealth is approximately $4.5 trillion. If Obama took all their money - including that of the non-Americans, he could fund his government for approximately 1.3 years.

“I mean, understand, it's not as if we haven't tried this theory. Remember that in those years, in 2001 and 2003, Congress

passed two of the most expensive tax cuts in history, and what did

they get us? The slowest job growth in half a century. Massive

deficits that have made it much harder to pay for the investments

that built this country and provided the basic security that

helped millions of Americans reach and stay in the middle class...."

- Barack Obama, Osawatomie, Kansas, 6 December 2011

- Barack Obama, Osawatomie, Kansas, 6 December 2011

"Those Bush tax cuts quickly ended the 2001 recession, despite the contractionary economic impacts of 9/11, and the economy continued to grow for another 73 months. After the rate cuts were all fully implemented in 2003, the economy created 7.8 million new jobs and the unemployment rate fell from over 6% to 4.4%. Real economic growth over the next 3 years doubled from the average for the prior 3 years, to 3.5%.

In response to the rate cuts, business investment spending, which had declined for 9 straight quarters, reversed and increased 6.7% per quarter. That is where the jobs came from. Manufacturing output soared to its highest level in 20 years. The stock market revived, creating almost $7 trillion in new shareholder wealth. From 2003 to 2007, the S&P 500 almost doubled. Capital gains tax revenues had doubled by 2005, despite Bush's 25% cut in the capital gains rate.

The deficit in the last budget adopted by Republican Congressional majorities was $161 billion for fiscal 2007. Today that deficit is nearly 10 times as much. Total federal revenues under Bush soared by nearly 30%, from $1.991 trillion in 2001 to $2.568 trillion in 2007. The day the Democrat Congressional majorities took office, January 3, 2007, the unemployment rate was 4.6%. George Bush's economic policies, "the failed policies of the past" in Obama's rhetoric, had set a record of 52 straight months of job creation."

According to the Bureau of Labor Statistics, job growth has been slower under Obama than under Bush: 40,500 jobs a month versus 68,000 jobs per month.

Mr Obama likes to argue that the "massive deficits" are the result of the Bush tax cuts and that returning to the Clinton tax rates, at least, for the wealthy would solve the fiscal problems. As we have seen, the "evil rich" aren't rich enough to fund his grandiose government, but his claims about the cause of the deficits is equally ridiculous. According to the Congressional Budget Office, the Bush and Obama tax cuts are responsible for less than 24% of the deficits accumulated in the last decade. Data provided by the CBO shows that the largest cause of deficits was increased spending, which accounted for 36.5% of the decline in the fiscal position of the United States over the last decade and entitlements are responsible for the rest.

More importantly, President Obama seeks to retain 70% of the Bush tax cuts, along with his payroll tax cut. When will he start taking responsibility for the deficits that he not only has generated, but will create? If the Bush tax cuts caused the deficits, then isn't Obama responsible for 70% of future deficits, at minimum, should he retain most of them?

Further, according to the Washington Post, "it is best to ignore raw numbers but instead focus on the size of the tax cut as a percentage of national income. Under that measure, the John F Kennedy tax cut of 1964 (-1.90%) and the Ronald Reagan tax cut of 1981 (-1.40%) were larger than Bush’s 2001 tax cut (-0.80%)."

Another idiosyncrasy that Obama has is to impute illegality to lawful behaviour. He will rail against the use, by corporations and "rich people," of loopholes and deductions, as though such is a crime. Let us be reminded of the famous axiom of Judge Learned Hand:

"Anyone

may arrange his affairs so that his taxes shall be as low as possible;

he is not bound to choose that pattern which best pays the Treasury.

There is not even a patriotic duty to increase one's taxes. Over and

over again, the Courts have said that there is nothing sinister in so

arranging affairs as to keep taxes as low as possible. Everyone does

it, rich and poor alike and all do right, for nobody owes any public

duty to pay more than the law demands."

-

Judge Learned Hand, Gregory v. Helvering, 69 F.2d 809, 810 (2d Cir.

1934), aff'd, 293 U.S. 465, 55 S.Ct. 266, 79 L.Ed. 596 (1935)

According to Obama, it is also fair to raises taxes on the top 2 brackets while further lowering payroll taxes, which pay current Social Security benefits and are the consideration that this generation of workers makes in order to receive such benefits when they retire.

Do Obama and Democrats even realise the consequences of their position? They are turning Social Security, etc., into welfare programmes, which Franklin Delano Roosevelt and the Progressives that created Social Security were vehemently against, and is undermining the precarious financial condition of them.

What is going to happen when politicians want to allow the payroll tax cut to expire? Will they be allowed to do so by a public that likes claiming that it is paying now for their retirement later, but, in reality, aren't paying at all or doing so in a de minimis fashion?

The "evil rich" do not have the money to fund Social Security and Medicare even if they are taxed at 100% much less just removing the cap on $106,800. Without the payroll taxes collected from all workers, Social Security and Medicare will generate even greater deficits than now and there will be reluctance by politicians to end the tax cut because, as Democrats have argued, it would raise taxes on the marginalised Middle Class. Thus, Democrats will continue to choose to undermine the very social safety net that they profess to champion. When will they be forced (by the bond market and demographics) to tell Americans that they will have no Social Security and Medicare in the future?

"Now, in the midst of this debate, there are some who seem to be

suffering from a kind of collective amnesia. After all that's happened,

after the worst economic crisis, the worst financial crisis since the

Great Depression, they want to return to the same practices that got us

into this mess. In fact, they want to go back to the same policies that

stacked the deck against middle-class Americans for way too many years.

And their philosophy is simple: We are better off when everybody is left

to fend for themselves and play by their own rules ..."

- Barack Obama, Oswatomie, Kansas, 6 December 2011

- Barack Obama, Oswatomie, Kansas, 6 December 2011

This statement is quite possibly the biggest lie that Obama has ever uttered. "Even before Obama was elected, under those "failed policies of the past," the top 1% of income earners in 2007 paid 40% of federal income taxes (up from 17.6% when Reagan entered office), while the CBO just reported that they earned 17% of the income in 2007. Moreover, that 40% of federal income taxes paid by the top 1% was more than paid by the bottom 95% combined, according to official IRS data. While the top 1% paid 40% of federal income taxes, the bottom 40% paid no federal income taxes as a group on net. Today, 47% pay no federal income taxes."

Far from letting the "evil rich" off the hook, Obama has seen to it that the nation's job creators, investors and small businesses will face massive tax increases in 2013 when the Bush tax cuts expire and the Obamacare tax rises go into effect. In that year, the top marginal rate will rise to 43.4% and the 2 rates will rise to by nearly 20%, the capital gains rate will skyrocket by 60%, the tax on dividends will triple, and the Medicare payroll tax on disfavoured taxpayers will increase by 62%. While Mr Obama and Democrats continue to repeat the 2008 mantra about returning to the Clinton tax rates, the tax rates on the top two brackets will far exceed those rates in 2013.

As I have previously written, the United States has, according to the OECD, the most progressive individual income tax system in the world and the highest corporate tax rate in the industrialised world at close to 40% on average, including state corporate rates. Further, as I have noted, the corporate tax rate in Communist China is only 25%. The average corporate tax rate in Socialist EU is even less on average and the rate in Progressive Canada is 16.5% and will be 15% next year.

"Now, it's a simple theory. And we have to admit, it's one that speaks to

our rugged individualism and our healthy skepticism of too much

government. That's in America's DNA. And that theory fits well on a

bumper sticker. But here's the problem: It doesn't work. It has never

worked. It didn't work when it was tried in the decade before the Great

Depression. It's not what led to the incredible postwar booms of the 50s

and 60s. And it didn't work when we tried it during the last decade. I

mean, understand, it's not as if we haven't tried this theory."

- Barack Obama, Oswatomie, Kansas, 6 December 2011

One would be tempted to call Mr Obama a liar here, but it is much more likely the case that this statement is just another example of his complete ignorance and idiocy when it comes to economics and economic history. Previously, I have explained the economics of the Roaring 20s, which were called that for a reason. These would be the years 1921-1929, when on account of a tax cut put together in 1921, the economy boomed at 4.8% per year as unemployment and inflation (the latter recently on a 100% run) both collapsed. You can read more about it here. I have also explained how, "If You Want Obamavilles, Repeat What Hoover Did" and you can read that piece here. I will say this:

Between 1945 and 1960, there were 5 recessions - many more than occur in a normal cycle. February through October 1945, November 1948 through October 1949, July 1953 through May 1954, August 1957 through April 1958, and April 1960 through February 1961. The trough of the recession at the end of World War II was 1947, when the Republican majority in Congress conspired to win a tax cut over President Truman’s veto. Result: a 6-year run of 4.8% growth.

When the recession came in 1953, Eisenhower refused calls for another tax cut and, as a result, there were 3 recessions during his administration and, when Eisenhower left office in January of 1961, he had presided over 8 years of an anemic 2.4% annual, average growth rate. In large part, that sluggish growth was due to high tax rates, not just on the wealthy, but on the middle class as well. In fact, increasing tax rates on the wealthy led to increases in tax rates on middle-class incomes.

Vice-President Richard Nixon paid a price for what Obama called this "incredible postwar boom." He lost to John F Kennedy, who -- all together now -- CUT TAXES.

After Kennedy's tax cut, which according to the Washington Post was the largest in history, the great 1960s boom ensued, with an average growth GDP growth rate of 4.9% between 1961 to 1969. Furthermore, between 1962 and 1969, investment grew at an annual rate of 6.1% far higher than the 3% annual rate for 1959-1962 and the 2.3% rate for 1969-1972, after the JFK tax reforms had been repealed. Real GNP grew 4.5% during the 1960s, higher than the 2.4% growth rate seen from 1952-1960.

So, what has NEVER worked is Keynesian economics. What is not working now is Obamanomics. What has continued to fail us now is that Obama's own policies, the exact opposite of what has worked in the past in every detail, have failed to produce any timely real recovery from the last recession. Prior to this last recession and since the Great Depression, recessions in the United States have lasted an average of 10 months, with the longest being only 16 months. Further, all data proves that the deeper the recession in the United States, the more robust the recovery ... that is, until now. Here we are, 48 months after the commencement of the most recent recession and there is no sign of any real recovery. Rather than a record recovery, we have record poverty, record food stamp usage, record child homelessness, record depressed prices in the housing market, record extended unemployment, and near records in fear of big government, distrust of our leaders and political system, and disapproval in the direction in which the country is heading.

Instead of changing course and adopting pro-growth and economic freedom policies, Obama pledges to give us more of what we do not want: A New Nationalism. For what it is worth, Theodore Roosevelt can be forgiven to a degree for falling for National Socialism / Socialism /Progressivism. After all, collectivism hadn't killed nearly 200 million people yet. Obama should know better, but classic narcissists believe that they can succeed where all others have failed.

Related Reading:

Big Government Robs The Middle Class Because That's Where The Money Is!

A Message To Leftists In The US & The UK From Sweden

Hey, Progs! Wanna Be Like Europe? How 'Bout You Start By Eliminating Estate Taxes?

Against Swedenisation

Hey, Progs! Wanna Be Like Europe? How 'Bout You Start By Eliminating Estate Taxes?

Against Swedenisation