M2RB: Megadeth

You take a mortal man,

And put him in control

Watch him become a god

Watch peoples heads a'roll

A'roll...

Just like the Pied Piper

Led rats through the streets

We dance like marionettes

Swaying to the Symphony ...

Of Destruction

Questions: America's politicians - especially its weak-willed President - may lack the guts to act to reduce the debt

By

Simon Heffer

After America postponed its jump off

the fiscal cliff in the small hours of Tuesday night, world stock

markets soared. Anyone listening to the BBC yesterday with its headlines

praising Barack Obama would think something quite profound had changed

in the world’s greatest — if battered — economy. However, it has not.

Intractable problems — chief among them chronic over-spending and weak consumer demand — have still not been solved.

The

tackling of those issues has merely been postponed until the end of

next month, when America’s legally enforceable ‘debt ceiling’ will

probably be reached.

That

will be the moment that U.S. debt passes a pre-determined point — north

of $16 trillion — and a raft of dramatic public spending cuts will be

triggered.

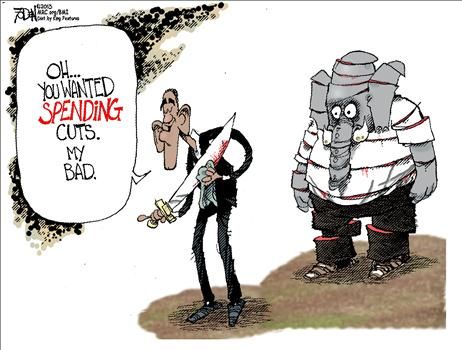

However, America’s politicians — especially its weak-willed President — may lack the guts to act even then to reduce the debt.

On

Tuesday, a self-serving and pitiful compromise was reached between

Republicans and Democrats to raise taxes by a small amount on the

richest Americans — those earning more than £245,000 a year will pay

39.6 per cent rather than 35 per cent.Yet

those traders who propelled international markets sharply upwards as a

result seem to have forgotten that America’s debt is an incomprehensible

$16.3 trillion (£10 trillion) and that its politicians are failing to

reduce it.

Instead — in a

tactic copied from the EU’s crisis-hit attempts to prop up the euro —

there may soon have to be yet another compromise, perhaps with an

agreement to increase America’s debt ceiling again. That would damage a

limping economy still further.

The

rest of the world — dangerously reliant on a buoyant U.S. — should note

one thing above all: the fundamentals of America’s economy are,

frankly, terrible, and its international dominance is not nearly as

assured as it once was.

Its economic culture has started to change since President Obama entered the White House four years ago this month.

America

more closely resembles Europe in living beyond its means and in the

President’s determination to build a massive welfare state.

The

danger is that none of his political opponents is powerful enough to

force through the decisions that would draw the U.S. back from its

economic precipice. They need to find massive spending cuts, and they

won’t.

The problem is that

the Democrats — who hold the Presidency and control the Senate — bribed

their way to victory two months ago.

Economic culture: America closely resembles

Europe in living beyond its means and in the President's determination

to build a massive welfare state

If Mr Obama had not promised to

look after all his client groups, especially among minorities, he would

be back home in Chicago. Now he has to pay out on those promises.

That

is pretty much the way New Labour operated in Britain, by creating a

vast state sector funded by the public purse that would, in return, vote

for Tony Blair and later Gordon Brown.

The long-term legacy of that self-serving policy can be seen today in our disastrous national debt.

The problem for America is that its per capita debt is worse even than ours.

It

may be a land of opportunity with a strong work ethic (though 12

million people are unemployed and 8.2 million work part-time), but it is

living seriously beyond its means.

If

the debt ceiling is reached, and it is only just above that current

£10 trillion debt, then automatic cuts will be enforced across the board

of government budgets — which would have a knock-on effect for the rest

of the world.

Self-serving: The long-term legacy of New Labour's vast state sector can be seen today in our disastrous national debt

Britain is the biggest overseas

investor in America. So when U.S. growth is feeble, we suffer because

there is a falling off in demand for our exports.

While

the markets rocketed yesterday, they may soon be going in the other

direction if a more robust and permanent solution to this American

crisis cannot be brokered.

The bigger picture, of course, is that in the past decade the U.S. has stumbled from one financial setback to another.

The

American people, and, indeed, the rest of the world, urgently need to

revise their view of how economically strong this ailing superpower

really is.

For those who have grown up assuming that America will inevitably lead the world economically, that will come as a shock.

Personally, I believe the U.S. is at a

similar point in its history to the one Britain reached in the 1890s,

when Germany overtook it: the once dominant world power is entering a

period of long and steady decline, as more efficient nations seek to

seize pole position.

One thing holding back American growth is its massive trade deficit, notably with China and other Asian economies.

Growth

at home is essential to create the wealth to reduce debt and the annual

budget deficit, which is around $1 trillion (£614 billion) a year.

The

fundamental problem is that President Obama’s ballooning public

sector, and the higher taxes already inflicted on small businesses, are

forecast to inhibit the private sector job creation America so

desperately needs to grow more quickly.

Higher business taxes cut money

for investment, which stops the innovation that might improve U.S.

productivity and therefore help its competitiveness.

Without growth, the debt will never decline as a proportion of America’s gross domestic product.

A

series of bad decisions in recent times have hobbled America. The first

was when Bill Clinton asked Alan Greenspan — then running the Federal

Reserve Bank — to make it easier for Americans to buy their own homes.

The

result was the sub-prime mortgage disaster, in which loans were made to

people with little hope of repaying them, for properties whose values

collapsed.

The bursting of the dotcom bubble — the collapse in the value of internet stocks — in 2001 also destroyed much American wealth.

However, President George W. Bush depended on the traditional resilience of his country’s economy to make good the damage.

It almost did, but fighting wars in Afghanistan and Iraq made huge inroads into economic reserves and into tax revenues.

That

plunge in tax receipts became worse after the collapse of Lehman

Brothers in autumn 2008, which triggered a widespread economic crisis

and a full-blown recession. And just as unemployment benefits started to

drain the economy, the number of pensioners rose as the baby-boom

generation, born after World War II, began to reach retirement.

Public debt is the equivalent of

£32,000 for each of the U.S.’s 320 million or so inhabitants — or over

100 per cent of GDP. It’s a terrifying figure.

When

Mitt Romney ran for office last year and promised to implement the

tough fiscal plan of his vice-presidential running mate, Paul Ryan, to

cut the deficit and the debt, the U.S. electorate rejected him.

If they thought they could avoid a political confrontation about spending and taxes, however, they were wrong.

That

is likely to come within six or eight weeks. Meanwhile, the uncertainty

about how — indeed if — America is going to put its financial house in

order will continue to destabilise its economy and deter investors.

Optimists say the country will pull itself up by its bootstraps, as it has before.

Certainly the advent of ‘fracking’ — extracting oil and gas cheaply from shale — must not be underestimated.

America

should have cheaper energy within a few years, which will lower the

costs of industrial production and distribution. But banking on that

alone to rescue an economic superpower is a risky business.

What America is doing is the equivalent of putting a bill behind the clock on the mantelpiece and hoping that it will go away.

But it won’t, it will only get bigger — and if it isn’t paid, the effects will be felt far beyond American shores.

Symphony Of Destruction - Megadeth

You take a mortal man,

And put him in control

Watch him become a god

Watch peoples heads a'roll

A'roll...

Just like the Pied Piper

Led rats through the streets

We dance like marionettes

Swaying to the Symphony ...

Of Destruction

Acting like a robot

Its metal brain corrodes

You try to take its pulse

Before the head explodes

Explodes...

The earth starts to rumble

World powers fall

A'warring for the heavens

A peaceful man stands tall

Tall...

And put him in control

Watch him become a god

Watch peoples heads a'roll

A'roll...

Just like the Pied Piper

Led rats through the streets

We dance like marionettes

Swaying to the Symphony ...

Of Destruction

Acting like a robot

Its metal brain corrodes

You try to take its pulse

Before the head explodes

Explodes...

The earth starts to rumble

World powers fall

A'warring for the heavens

A peaceful man stands tall

Tall...

No comments:

Post a Comment