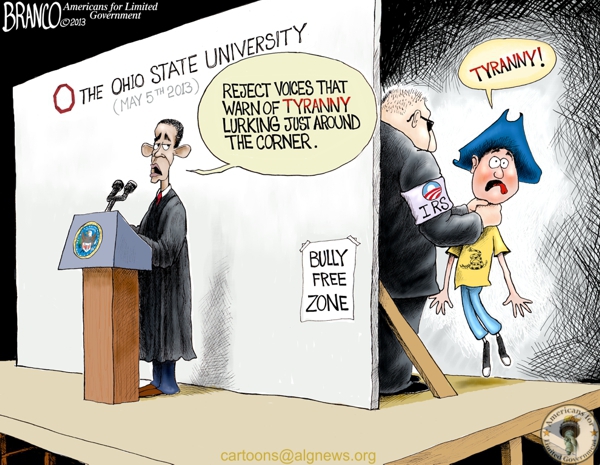

Debunking the IRS excuses and evasions

By Daniel Foster

Much of the liberal intelligentsia

(including those in the Obama administration) have, to their credit,

condemned the IRS targeting of conservative groups — or at the very

least, have not sought to defend it. Perhaps that’s because all of the

early attempts at justifying, excusing, minimizing, insulating, and

explaining away the practice came up so short.

It was just Cincinnati.

This

was one of the earliest attempts to minimize the bigness of this deal,

one cooked into the IRS’s own statements and apologies. It is also one

of the lamest.

It’s true that much of the targeting took place at

the IRS’s Cincinnati offices, but that’s because that’s where the IRS’s

Tax Exempt and Government Entities Division is headquartered.

If I punched you in the face, you wouldn’t take much comfort in my blaming only my hand. Besides, there were other offices involved — according to the Washington Post, at least two in California and one in D.C.

It was just “rogue,” “front line” people.

Similarly,

the IRS’s 501(c) honcho, Lois Lerner, along with administration

officials and their defenders in the media, emphasized that these were

“front line” employees, not senior managers or political appointees.

Just Wednesday, acting IRS commissioner Steven Miller claimed he had

identified two “rogue” employees responsible for the bulk of the

targeting. But the coordination between offices, and the involvement of

Washington, cast doubt on the idea that this was a two-man job. Lerner

became aware of the targeting, at the very latest, in 2011, and the IRS commissioner and his deputy learned

about it in May of 2012. But none saw fit to go public with that

knowledge, even though there were during this time well-documented

complaints of excess scrutiny that were emanating from tea-party groups.

Miller may have even lied about the targeting operation in response to

congressional inquiries.

There was no political motivation.

Lerner

has also claimed that there was no political bias involved in the

decision to put conservative groups through the ringer. She would not

elaborate on how she knows this except to say, “That is not how we do

things.” This might be easier to swallow if hers hadn’t been the same

division that last year illegally leaked tax information about Karl

Rove’s Crossroads GPS to George Soros’s ProPublica.

The IRS was “going where the action was.”

Both Ezra Klein and Kevin Drum

have made the argument that, though it went about it sloppily, the IRS

was trying to solve a legitimate problem: how to flag improper

applications amid an explosion of applicants. They chose conservative

linguistic markers, according to Klein, because there had been an

increase in tea-party-themed applicants, and “like Willie Sutton robbing

banks, [IRS auditors] were going where the action was.” The problem

with that is it sounds a lot like the kind of profiling folks like Klein

and Drum typically abhor in criminal investigations. And in a way, it’s

worse,

since the IRS has not presented any evidence, or any ex ante reason

besides pure political bias, to think conservative groups were more

likely to file unqualified applications than any other kind of group. As

Megan McArdle rightly argues, the way to figure out where to focus your energy when you see a massive surge in applications is to take a random sample. The whole issue here is that the IRS took a decidedly non-random one.

No comments:

Post a Comment