By Veronique de Rugy

The

main message from the president’s debt-ceiling press

conference yesterday was that Congress must give the

administration more borrowing authority without any strings attached. In other

words, the president wants business as usual to prevail in Washington.

That’s unfortunate because here is where business as usual has taken us so far:

*

$16.4 trillion in debt. The government

has borrowed over $2 trillion since we had this debate last in the summer of

2011.

* The government is not only addicted to

spending, it is also addicted to borrowing. For every dollar it spends, it

borrows 40 cents. Every month it spends $100 billion more than it collects in

tax revenue. That’s over $1 trillion a year in deficits.

* Government spending as a share of GDP is

high: 23.5 percent in 2012. We are far from the 18.2 percent of the end of the

Clinton terms.

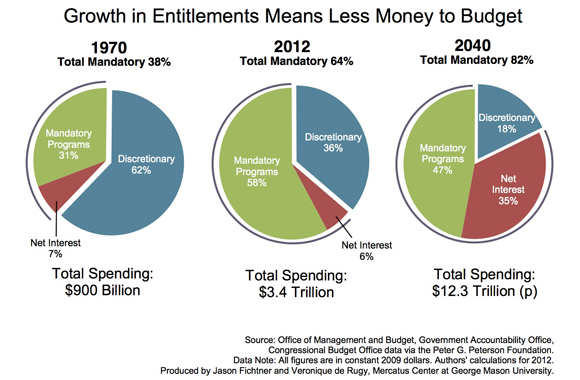

* Spending on mandatory programs such as Social

Security, Medicare, and Medicaid consumed 31 percent of the budget in 1970.

Today they consume 58 percent of the budget.

* Without significant spending reforms, the

interest we pay on our debt alone will consume 35 percent of our budget by

2040, up from 6 percent today.

*

Congress and the administration — whether Republican or Democrat — regularly

make promises to voters without any idea of how they will pay for them. A recent

estimate shows that the total long-term imbalance of Social

Security and Medicare’s Parts A, B and D alone is $66 trillion, and restoring

them to sustainability will require almost doubling the payroll-tax rate

(something no one wants to do). Yet, Washington added another enormous

federal entitlement in March 2010 with Obamacare.

* Without leverage and without a crisis in

sight, Congress never cuts spending; note it hasn’t even bothered to pass a

budget in years.

The

chart below is

updated from one the Peter G. Peterson Foundation published in their 2010 “Spending

Primer.” It’s a good illustration of what business as usual

will mean for Americans:

Without reforms to Social Security,

Medicare, and Medicaid, and without a way to slow down the spending consumed by

these programs, the government will continue to spend significantly more money

than it collects. It will continue to borrow — probably at an increasing rate —

and all spending other than on interest payments and mandatory programs will be

squeezed out.

It

is a sign of how dysfunctional Washington has become that it takes a crisis

such as the country hitting the debt limit yet again to force a conversation

about how to put us on a sustainable fiscal path. It is also a sign of how deep

Washington’s addiction to spending and borrowing has become that outside of

these crises, Congress forgets about fiscal discipline altogether. The attempts

by Republicans and Democrats alike to avoid the implementation of sequestration

cuts is a good example of this.

Now,

there is no doubt that the debt ceiling must be raised. Also defaulting is not

an option (read

Kevin Williamson’s piece about how defaulting doesn’t mean

not paying all of our bills). But while it is not ideal to use a crisis to

demand that the president and Congress acknowledge that the path we are on is

unsustainable, it beats continuing business as usual.

By

the way, Fitch seems to expect the U.S. government to have a serious

conversation about its addiction to borrowing. This morning, the rating agency

announced both that the country will suffer a downgrade if it doesn’t pay all

of its bill and that it may also suffer a downgrade if lawmakers raise

the debt limit without attempting to lighten our debt problems. Here

is the Wall Street Journal on the announcement:

Fitch said Tuesday that it may

downgrade the nation’s debt even if lawmakers raise the debt ceiling, if

Washington emerges from those negotiations without taking steps to lighten the

U.S. debt load.

Fitch, owned by Fimalac SA and

Hearst Corp., currently assigns U.S. debt its highest rating of triple-A. But

that rating has a negative outlook, meaning a downgrade is more likely than if

the outlook were stable.

“In the absence of

an agreed and credible medium-term deficit reduction plan that would be

consistent with sustaining the economic recovery and restoring confidence in

the long-run sustainability of U.S. public finances, the current negative

outlook on the ‘AAA’ rating is likely to be resolved with a downgrade later

this year even if another debt ceiling crisis is averted,” Fitch analysts

said in Tuesday’s report.

|

No comments:

Post a Comment