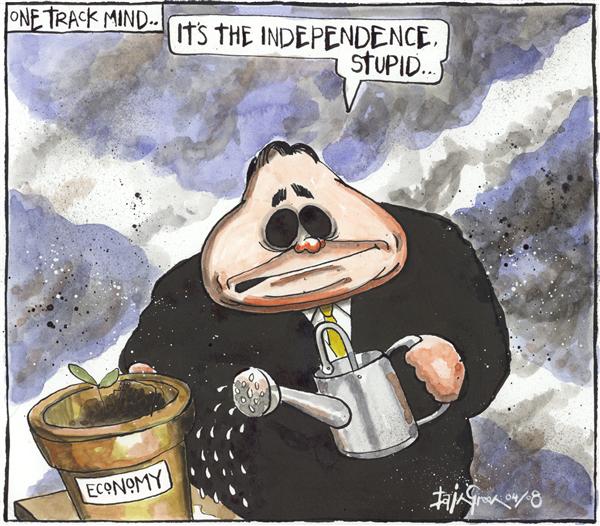

- Rattled Salmond launches extraordinary rant at the BBC after it revealed Royal Bank of SCOTLAND will quit country after 'Yes' vote

- First Minister lashes out at broadcaster to deflect row over threat by banks

- RBS one of four major banks to turn its back on independent Scotland

- John Lewis, Waitrose and Asda say prices will rise if there is a Yes

- SNP leader was accused of lying about oil reserves by industry members

- He calls for official inquiry into Treasury source who leaked RBS story

- Insurance giant Standard Life said it would move south days after Yes vote

By Alan Roden, for Scottish Daily Mail

Alex Salmond today launched an

extraordinary rant at the BBC after the broadcaster reported how even the Royal

Bank of Scotland planned to relocate to England in the event of independence.

In a bizarre press conference he launched

a series of petulant attacks on the BBC, Westminster leaders and the Australian

prime minister.

And he revealed he has called for an

official inquiry into the Treasury's 'deliberate attempt to cause uncertainty

in the financial markets' by leaking details of RBS's fears about the breakup

of the Union.

First Minister Alex

Salmond launched into a rant aimed at the BBC after it first reported how Royal

Bank of Scotland would relocate its headquarters if voters back independence

Mr Salmond appeared to

question the BBC's impartiality as he accused the broadcaster of leaking market

sensitive information about RBS.

Mr Salmond clashed with BBC political

editor Nick Robinson over the coverage of the warning from banks that they

would move they headquarters south of the border

Alex Salmond clashes

with BBC's Nick Robinson over RBS (related)

In a hammer blow to separatists RBS,

Lloyds, Clydesdale and Edinburgh-based TSB will move to England if the 'Yes'

campaign win next Thursday's referendum - and more could follow.

Mr Salmond responded that his Better

Together rivals had launched a campaign of 'scaremongering' and 'intimidation'

and financial institutions relocating would have no impact on an independent

Scotland.

The First Minister presided over an

astonishing press conference for the world's press corps in which he was

tetchy, rattled and – according to several observers – 'losing the plot'.

Another observer suggested this was Mr

Salmond's 'Sheffield rally', a reference to Neil Kinnock's ill-fated cry of

'We're alright!' before he went on to lose the 1992 General Election.

At one point there was an ugly clash

between the SNP leader and BBC political editor Nick Robinson over the fate of

Scotland's banks if there is a Yes vote in next week's referendum.

Big move: The Royal Bank

of Scotland has revealed it would move its headquarters from Edinburgh,

pictured, to London if voters choose independence next week

ALEX SALMOND

ROUNDS ON BBC POLITICAL EDITOR NICK ROBINSON

Alex Salmond launched an astonishing

tirade against BBC political editor Nick Robinson.

He accused the highly-respected

broadcaster of 'heckling' him when he urged the SNP leader to answer his

question.

Mr Salmond attacked BBC coverage of

Lloyds' decision to move its headquarters to London, saying the bank has always

been based in the UK capital.

Brandishing a printout of an article, he

said 'you Nick or one of your colleagues' was responsible, saying the leak was

'as serious a matter as you possibly can get'.

He was again applauded by his supporters

as he said: 'I know the BBC in its impartial role as a public sector

broadcaster will give full cooperation to that investigation.'

Mr Salmond attempted to move onto the

next questioner but Mr Robinson repeatedly challenged him to answer questions

about the impact of the banks' warnings, prompting the First Minister to attack

him.

'This has been a lively campaign across

Scotland with heckling at many meetings across Scotland. This is the first

opportunity the BBC have had to heckle at a meeting,' he said, laughing to

himself, before repeating his demand for the Corporation cooperate with an

inquiry.

In another show of petulance, he attacked

Australian Prime Minister Tony Abbott, who recently said an independent

Scotland would not be in the best interests of the international community.

Mr Salmond said he had received letters

from Scot-Australians distancing himself from their premier's views, adding

that it could backfire for Mr Abbott at the ballot box.

And, chuckling to himself, he said he

would 'never' speak of the Conservative Party in the way David Cameron did on

Wednesday, when the Prime Minister said Scots should not vote Yes because they

don't like the 'effing Tories'.

Scottish Conservative deputy leader

Jackson Carlaw said: 'Considering the eyes of the world are now on Scotland,

this was an utterly embarrassing episode.

'The foreign media must have wondered

what was going on when the activist corps joined the press one.

'The First Minister looked like a man in

danger of losing the plot, and his conduct – and that of organisers –

transformed an opportunity to interrogate Alex Salmond into a laughable circus

in front of a global audience.'

Mr Salmond tried to deflect from the

seismic interventions by demanding an investigation into who briefed the BBC

about plans drawn up by RBS to move its registered headquarters to England.

In a mocking tone, the First Minister said

he would expect the full cooperation of the 'impartial' broadcaster – prompting

cries of 'BBC bias' from the crowd.

The Yes campaign had filled the

auditorium at the Edinburgh International Conference Centre with

pro-independence supporters, mingling with journalists, making it unclear who

was applauding as the attacks continued on the BBC and the 'metropolitan

media'.

But the series of announcements by big

banks came as the 'No' camp moved back in the lead in a new poll.

The latest Survation survey found 53 per

cent of Scots would say No in next week's referendum on independence, with the

Yes camp on 47 per cent. One in ten has yet to decide.

RBS, based in Scotland since its

formation in 1727 , said today 'it would be necessary to re-domicile the bank's

holding company' if next Thursday's referendum ends the 307-year Union.

Banks say they fear being downgraded if

they lost the stability of the Union and RBS and Lloyds may even ask for emergency

Westminster legislation to help speed through a move to England.

RBS employs 12,000 staff north of the

border and is still headquartered in Gogarburn, to the west of Scottish capital

Edinburgh, but this main base would be moved south.

Lloyds Banking Group, which includes

Halifax and Bank of Scotland and has 16,000 staff in

Scotland, yesterday announced it would move its headquarters to London, in

what has been called Alex Salmond's 'Black Wednesday'.

Scotland's third bank, Clydesdale, was

also reported to be preparing to leave and Edinburgh-based Standard Life said

it would partially move to England, putting up to 5,000 finance jobs at risk.

And Edinburgh-based Standard Life

unveiled drastic plans to partially move to England, putting up to 5,000 finance

jobs at risk.

John Lewis, Waitrose and Asda caused

further damage to the Yes campaign today after it said shoppers in Scotland are

likely to face higher prices if the country votes in favour of independence,

days after B&Q gave the same warning.

And yesterday BP and Shell also came out

against independence and Alex Salmond was accused of lying about oil reserves

on what was being dubbed the First Minister's Black Wednesday.

Edinburgh-based TSB, which recently

returned to the London stock market after two decades having split from Lloyds,

also said it will establish additional legal entities in England.

On the road: The most senior member of

the Labour party were in Glasgow today to hear Ed Miliband speak as the Better

Together campaign regained a slight lead in the polls

RBS' PLEDGE TO

LEAVE SCOTLAND IS SYMBOLIC AND ECONOMIC BLOW

Royal Bank of Scotland grew to become one

of the largest and most aggressive banks in the world - but its roots have

always been firmly in its home country.

But today RBS said it will register

themselves in England if Scotland votes for independence in next week's

referendum.

It would be a symbolic blow but also an

economic one because going south means Scotland would miss out on earnings from

trading and exports.

The bank was founded in Edinburgh in

1727, but by the end of the 20th century it was a major player in the City of

London too as the UK capital became the world's leading financial centre.

RBS sealed its place at the top table of

British banking in 2000 when it bought NatWest, which dates back to 1650 and

was considered one of the 'Big Four' retail banks in the UK.

Fred Goodwin, above right, became chief

executive of RBS the following year and pioneered a gung-ho expansion strategy

with resources poured into its investment banking division.

One of the biggest deals came when RBS

joined a consortium to buy Dutch bank ABN Amro for £49billion, which was later

revealed as a major overvaluation.

With the advent of the 2007 credit crunch

and subsequent global financial turmoil, RBS was exposed as being dangerously

indebted and unable to meet its obligations.

The Labour Government felt it had no

option but to step in, and in October 2008 it took a 57 per cent stake in the

bank in return for £37billion of new capital.

As the bank's losses spiralled and it

required even more bail-out money, the state share of the firm rose to 82 per

cent.

Much of the blame for RBS's troubles was

attributed to Goodwin, who was forced to resign and subsequently stripped of

the knighthood he had received in 2004.

The wider group is already registered in

England but the banking operation is in Scotland, where it has 189 of its 631 branches

and almost 2,000 staff.

It said: 'Any change in TSB's legal

structure would be taken in the interests of our customers and business.

'In the event of a Yes vote, it is clear

that independence will not happen straight away and there would be a period of

time between the referendum and implementation of independence, which we expect

would provide sufficient time for us to consider and implement any necessary

changes.’

Lloyds Banking Group, which includes

Halifax and Bank of Scotland and has 16,000 staff in Scotland, yesterday,

announced it would move its headquarters to London.

Banks say they fear the lost stability of

the Union and RBS and Lloyds may even ask for emergency Westminster legislation

to help speed through a move to England.

Scotland's third bank, Clydesdale, was

also reported to be preparing to leave and Edinburgh-based Standard Life said

it would partially move to England, putting up to 5,000 finance jobs at risk.

Others could follow with Tesco Bank,

Scottish Widows and Virgin Bank all headquartered or registered in Edinburgh,

and together support thousands of jobs in Scotland's capital.

And Edinburgh-based Standard Life

unveiled drastic plans to partially move to England, putting up to 5,000

finance jobs at risk.

The First Minister says reports of banks

leaving Scotland are 'nonsense' and 'scaremongering'.

Mr Salmond added that the No campaign has

been 'caught red-handed as being part of a campaign of scaremongering'.

'I'm not making that position against any

of the companies concerned,' he said.

'But quite clearly if you brief market

sensitive information last night to one broadcaster which was meant to be

released at 7am this morning, it put this Treasury fingerprints all over this

story, and it provides a spectacular example of the sort of campaign tactics of

intimidation and bullying that have served the No campaign so badly.'

Mr Salmond's vision of an energy-rich

future was also dismissed as a fantasy by a leading Scottish oilman and BP and

Shell also came out against independence.

And Bank of England Governor Mark Carney

piled on the pressure by warning that Edinburgh would have to set aside around

£130billion to guarantee savers' bank deposits.

Today more than one hundred business

leaders from all over Scotland have also backed a No vote.

Leading business figures in all sectors

across Scotland said they have concluded that the economic risks of separation

are not worth taking.

Food prices will rise in an independent Scotland, says supermarket giant

Asda as Next and John Lewis warn of rising costs

Supermarket giant Asda today became the

biggest retailer to warn shoppers that prices will rise in Scotland if becomes

an independent country.

In a blunt warning to customers,

Britain's second largest retailer said trading across a new border would make

business more 'complex' and push up costs.

The pain would be felt by the working

class vote being targeted by both sides in the referendum campaign, and comes

after big names like John Lewis and B&Q warned their prices would rise in

an independent Scotland.

Supermarket giant Asda said it costs more

to do business in Scotland, which would be passed on to shoppers if it became a

separate country

First Minister Alex Salmond today tried

to brush aside the warnings about the devastating impact of independence on

family budgets, claiming the threats were not new.

But with just a week until the historic

vote on breaking up the union and the latest poll putting No ahead,

pro-independence campaigners will struggle to reassure going it alone will not

hit Scots in their pocket.

Our business model would inevitably

become more complex. We would have to reflect our cost to operate

Operating in Scotland is more expensive

more for large retail chains than in more densely populated parts of England,

but they absorb the costs to ensure prices are the same across the UK.

But if Scotland becomes a separate

country it would be treated like other overseas operations where prices are

higher.

Today Asda issued its strongest warning

yet that prices would have to rise.

Andy Clarke, president and CEO of Asda,

said: 'If we were no longer to operate in one state with one market and –

broadly – one set of rules, our business model would inevitably become more

complex. We would have to reflect our cost to operate here.

'This is not an argument for or against independence;

it is simply an honest recognition of the costs that change could bring.’

'For us the customer is always right and

this important decision is in their hands.'

It came hours after the head of the John

Lewis Partnership also warned it would cost Scots more to shop in their nine

John Lewis and Waitrose stores.

Chairman Sir Charlie Mayfield told BBC

Radio 4: 'It does cost more money to trade in parts of Scotland and therefore

those hard costs, in the event of a Yes vote, are more likely to be passed on.'

He added: 'On the day after the

referendum the shops are going to open on time, nothing will change.

'For various reasons - regulation and

transport costs etc - it does currently cost more money to serve parts of

Scotland.

'Most retailers don't run different

prices, they absorb that in the totality.

'If you go forward several years and you

see a divergence of different things - particularly currency - that creates the

likelihood, not the certainty, that costs would be higher.

'And when you are talking about two

different countries it is most probable that most retailers would then start

pricing differently.

'My view would be that the likelihood is

that that would lead to some higher prices.'

Lord Wolfson, the boss of clothes store

Next, also voiced fears about the impact of independence, including the loss of

well-paid workers from the financial sectors who could move south.

He said: 'I'm worried about three things:

currency, taxes and jobs. Whatever currency comes in in Scotland, it's likely

to be weaker than the one they've got, and that is likely to push up prices.

'Nobody quite knows what the financial

situation will be in Scotland — it may be fine but there is obviously a risk

that taxes will have to go up and financial-services firms are already saying

that if there is a 'Yes' vote, they'll leave.'

Former Prime Minister Gordon Brown,

speaking in Kilmarnock today, insisted the Yes campaign 'can't dismiss

all of the warnings all of the time'

Earlier this week the boss of B&Q

owner Kingfisher warned the costs of DIY would rise in an independent Scotland.

Sir Ian Cheshire had already warned he

will mothball investment in Scotland if it votes for independence until details

of the separation becomes clear.

But he went even on Tuesday saying:

'Smaller, more complex markets often mean passing higher costs on to consumers.

We think there is a real risk in terms of higher costs, the uncertainty about a

currency union and the difficulty of making investment decisions. Investment decisions would be on pause while

we work out what's likely to happen.’

We are not going to pick up stores and

move them south of the Border, but [a Yes vote] would represent real and

significant challenge for our business.'

Scottish Labour MSP Jackie Baillie said:

'The cost of doing business here is higher than the rest of the UK, but because

we pool and share resources that keeps costs down. If we vote for separation

then we are voting for higher shopping prices. Scottish families should be in

no doubt – if we vote to leave the UK it would cost us all dear.

'Why take on the risk of separation when

we can have the certainty of change within the UK?'

But Scottish Finance Secretary John

Swinney said other major retailers had rejected claims prices would rise.

'I think the argument is one that is

firmly contested by other retailers,' he said.

Alex Salmond has been pilloried after unveiling a blueprint for Scottish

independence that assumes the English would continue to share the UK’s

‘crown jewels’ including the pound and BBC programmes.

The First Minister’s long-awaited White Paper on independence promised

Scotland “will” retain sterling and would seek to join the EU on the same

terms as the UK, including a euro opt-out and a share of Baroness Thatcher’s

rebate.

A separate Scotland would assume a much lower share of the UK’s national debt

than previously thought, spend more on childcare and a new Scottish

Broadcasting Service would show the BBC’s output, the document said.

But Mr Salmond refused to acknowledge that the English, Welsh and Northern

Irish may not go along with his “common sense” proposals if there is a ‘yes’

vote in September’s referendum.

The 650-page document contained no ‘Plan B’ for a separate Scotland’s currency

despite a series of political figures led by George Osborne, the Chancellor,

warning that a deal to share sterling was unlikely.

Alistair Darling, the former Chancellor and leader of the pro-UK Better

Together campaign, said the Scottish Government had produced a “wish list of

political promises” with few details or costings.

The White Paper did not attempt to price the setting up of a new nation state

or address a report by the impartial Institute for Fiscal Studies last week,

which said an extra £6 billion of spending cuts or tax rises would have to

be found.

Keeping sterling is vital to Mr Salmond’s hopes of winning the referendum,

with the White Paper promising Scots that their pensions and mortgages would

be unaffected by independence.

And,

after Scotland is not refused a currency union, EU membership (for at

least 5 years), and is not admitted to NATO, what will happen then to

sweet, 'lil Nessie?

Related Reading:

No comments:

Post a Comment