"Senate Democrats will push a one-year tax cut proposal for individual

Americans earning $200,000 or less annually, setting the stage for a

showdown in coming weeks with Republicans over extending the Bush tax

cuts, according to a new plan circulating on Capitol Hill. Couples with a combined $250,000 income will also be covered by the Democratic proposal."

- Politico, Senate Dems push one-year tax cut, 13 July 2012

Maintaining current rates for those individual earning $200,000 or less annually or couples with a combined $250,000 income IS NOT A TAX CUT.

According to Princeton, a tax cut is the act of reducing taxation. The

same definition is given by the Free Dictionary online: the act of

reducing taxation. Again, maintaining current rates is not a tax cut in any way, shape, or form.

I ask

you to take note of the fact that Obama and the Democrats have gone from

campaigning on making these "cuts" permanent to now offering a

"one-year extension."

There is a reason for the change for those smart enough to understand

math and to those of us who listen closely to the words Democrats say:

[From a 2010 article] "In the near term, House Majority Leader Steny Hoyer raised the possibility that Congress will only temporarily extend middle-class tax cuts set to expire at the end of the year. He pointedly suggested that making them permanent would be too costly.

Tax cuts enacted under former President George W. Bush are scheduled to expire at the end of the year, affecting taxpayers at every income level. President Barack Obama proposes to permanently extend them for individuals making less than $200,000 a year and families making less than $250,000 — at a cost of about $2.5 trillion over the next decade.

[From a 2010 article] "In the near term, House Majority Leader Steny Hoyer raised the possibility that Congress will only temporarily extend middle-class tax cuts set to expire at the end of the year. He pointedly suggested that making them permanent would be too costly.

Tax cuts enacted under former President George W. Bush are scheduled to expire at the end of the year, affecting taxpayers at every income level. President Barack Obama proposes to permanently extend them for individuals making less than $200,000 a year and families making less than $250,000 — at a cost of about $2.5 trillion over the next decade.

“As the House and Senate debate what to do with the expiring Bush tax

cuts in the coming weeks, we need to have a serious discussion about

their implications for our fiscal outlook, including whether we can

afford to permanently extend them before we have a real plan for

long-term deficit reduction.”

- Rep. Steny Hoyer (D-MD), 2010

That was in 2010, but fear not. His aims haven't changed!

Following

a speech before the Centre for American Progress, House Minority Whip

Steny Hoyer (D., Md.) said Monday. 9 July 2012, he would support tax

increases on those who earn less than $250,000 at some point in the

future.

“The president initially has it about right, at the ($250,000 level).

But I would be prepared to go lower at some time in the future than

that. Our economy is still struggling and I think going

lower than that would have adverse impact on the economy. I don’t think

going higher than that will have an adverse impact.”

- Steny Hoyer, (D-MD), 13 July 2012

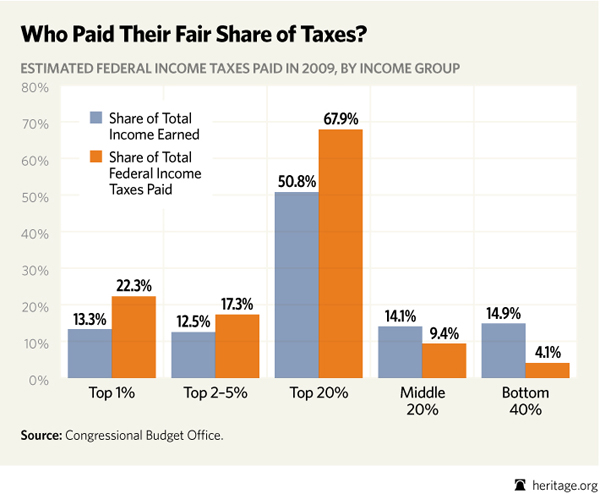

Top 1%

Share of Total Income Earned: 13.3%

Share of Total Federal Income Taxes Paid: 22.3%

Top 2-5%

Share of Total Income Earned: 12.5%

Share of Total Federal Income Taxes Paid: 17.3%

Top 20%

Share of Total Income Earned: 50.8%

Share of Total Federal Income Taxes Paid: 67.9%

Middle 20%

Share of Total Income Earned: 14.1%

Share of Total Federal Income Taxes Paid: 9.4%

Bottom 40%

Share of Total Income Earned: 14.9%

Share of Total Federal Income Taxes Paid: 4.1%

Source: Congressional Budget Office

The Top 40%

Share of Total Income Earned: 71.0%

Share of Total Federal Income Taxes Paid: 86.5%

The Bottom 60%

Share of Total Income Earned: 29.0%

Share of Total Federal Income Taxes Paid: 13.5%

In 2009, the top 400 taxpayers paid almost as much in federal income taxes as the entire bottom 50 percent combined.

You will see a lot of news on this report. What you are unlikely to see, though, are these facts from the CBO report:

- On just federal-level taxes, the top 1 p% of income earners already have an effective tax rate of 29%. (This should please Warren Buffett!)

- President Obama has achieved his goal of increasing redistribution: The top 20% has seen its after-tax share of total income fall, especially the top 1%, while the lower income groups have seen their share rise.

- The top 1% pays well over its “fair share”—it pays a much larger share of taxes (22.3%) than the share of income it earns (13.3%)—as does the full top 20%. Meanwhile, the bottom income groups pay a much smaller share of taxes than their share of income: The bottom 40% earned 14.9% of income, but paid just 4.1% of federal taxes. (See chart)

So when the President and the his supporters complain that the rich

are not paying their fair share of taxes, and Warren Buffett suggests

another tax to ensure that they start paying more, someone should show

them this government report. If the argument is that America must ensure

that the rich pay, it must just be rhetoric—because they are already

paying.

THERE ARE COMING FOR YOU EVENTUALLY because, as I've always reminded:

Big Government robs the middle class for the same reason that Willie Sutton robbed banks…that’s where the money is!

No comments:

Post a Comment